Living in New York, London, or Tokyo is what dreams are made of. Many people see this is as one of their biggest life goals – a sign that they’ve “made it”.

However, these are examples of “Very High Cost of Living” (VHCOL) cities. And while living in a VHCOL city can be rewarding, it also presents unique challenges for your personal finances, especially if you aren’t retired and your goal is to grow your wealth.

What is a VHCOL city?

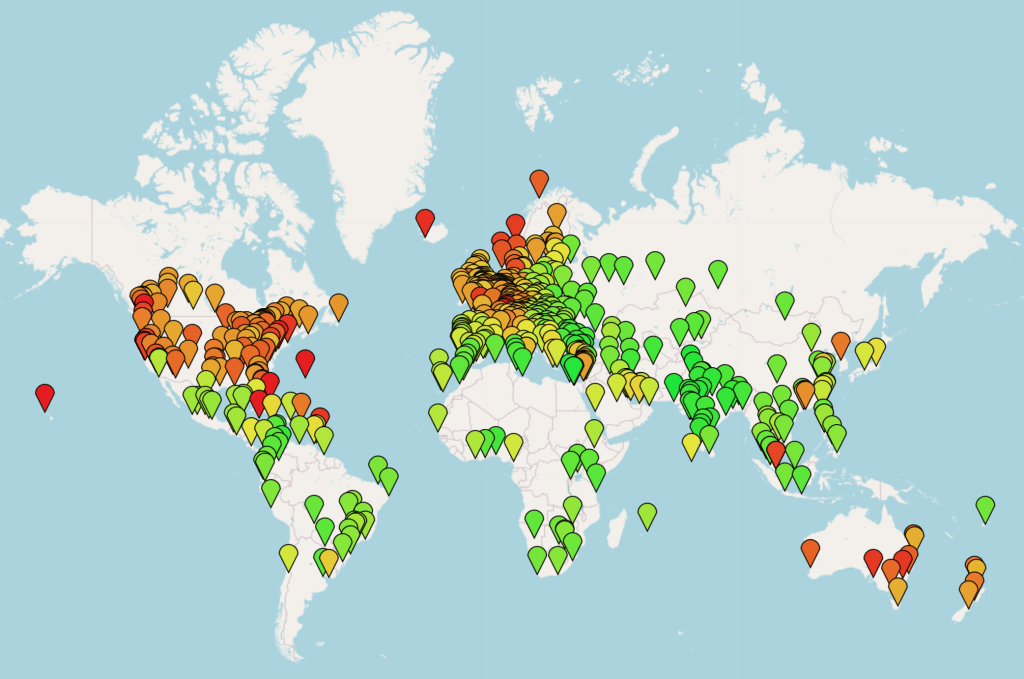

While there is no official definition of a VHCOL city, it’s safe to say that if your city is on the Top 100 list of the Cost of Living Index 2023, then you live in a VHCOL city.

While VHCOL cities come with a number of benefits, living in a VHCOL city is often much more expensive than living elsewhere – as the name suggests.

So what should you do, if you live in a VHCOL city, and you want to achieve financial freedom?

Nail the Essentials

Living in a VHCOL city means you have less room for error.

- Manage your debt.

- Maintain a strict budget.

- Build an emergency fund.

- Have appropriate insurance.

These are non-negotiable for you now. Higher cost of living means a higher risk of lifestyle creep.

Maximize Your Income

Most people move to VHCOL cities for the job opportunities, so make sure your income is growing proportional to your expenses.

- Learn new skills.

- Invest in your education.

- Build and nurture your network.

- Make sure you’re being paid fairly.

If you’re not maximizing your income in the VHCOL city, you may want to re-consider if the city is for you.

Minimize Housing Costs

Housing tends to be the most significant expense in VHCOL cities.

- Consider downsizing.

- Share accommodation with a roommate(s).

- Exploring less expensive neighbourhoods within the city.

You can still enjoy many of the benefits of living in a VHCOL city while living in a suburb, or with roommates.

Be Smart with Taxes

This is often overlooked, but VHCOL cities often have higher tax rates.

- Familiarize yourself with local tax laws and regulations.

- Look into any deductions and credits specific to your area.

- Consider consulting a tax professional so you don’t miss any opportunities.

Invest in Yourself

VHCOL cities often offer a range of investment opportunities. Especially if the VHCOL city is continuing to grow, and people are still moving to the city in droves, it may present an opportunity for real estate investments.

Perhaps most importantly is to invest in your network. Like financial investments, your relationships will compound over time. And one of the benefits of living in a high-quality city is that they’re often filled with high-quality people. This means you need to become a high quality person yourself.

Living in a VHCOL city has plenty of benefits, but it comes at a cost. If you don’t want to live paycheque to paycheque, make sure you are optimizing your finances so that you can continue to build your wealth.

To your prosperity,

Wealth Potion

Pingback: What is FatFIRE and How Much to FatFIRE - Wealth Potion