Understanding How the Financial System Affects Your Job

If you work(ed) in B2B Tech, you no doubt have seen / heard / experienced the layoffs of the past few years.

If you were laid off, I’m here to tell you that it wasn’t your fault.

Of course, it’s healthy to take some level of accountability for our performance at work, our careers, and so on.

That’s not my point.

Today, I’ll demonstrate how our financial system, the pandemic, and the ensuing government intervention directly led to layoffs several years later.

We’ll walk through step-by-step:

- Recession in the economy

- Stimulus by the government

- Inflation and the Lag Effect

- Tightening of interest rates

- Layoffs especially in B2B tech

Let’s dive in.

The (Fear of) Recession

In 2020, we had a once-in-a-century pandemic.

By all accounts, it was a Black Swan – a very impactful event that no one could have predicted.

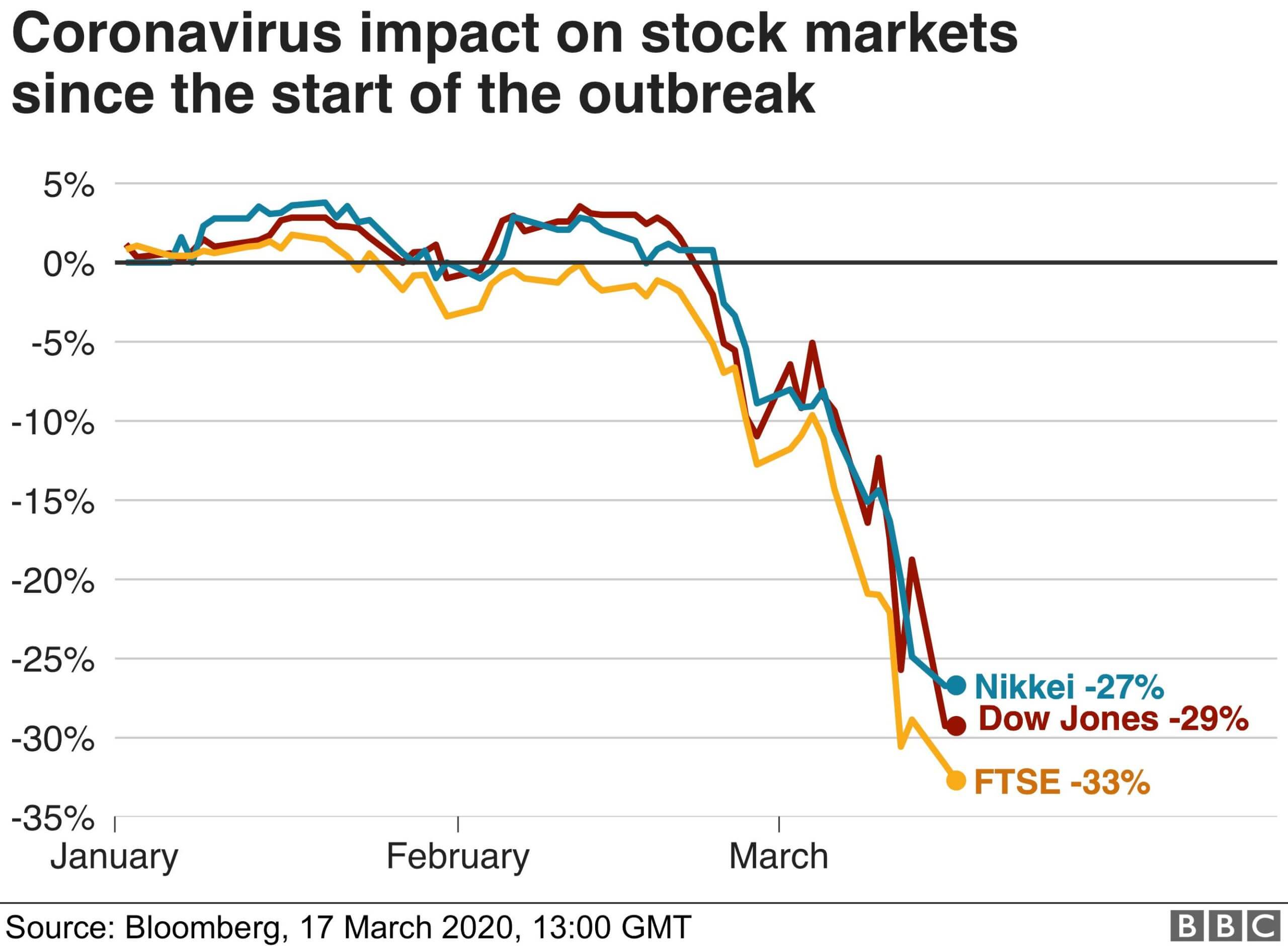

The stock market crashed as a result.

It’s important to note that although the stock market is not the same as the economy, the stock market can certainly influence the economy.

The stock market is forward looking. And if investors fear for a recession, it can ironically lead to an actual recession in the economy.

And so the government decided that they had to act…

Government Stimulus Saves the Day

Stimulus was injected into the economy in multiple ways:

- Extended unemployment benefits

- Payments to individuals (“stimulus checks”)

- Temporary debt forgiveness (e.g. student loans)

- Paycheck Protection Program (PPP) loans to businesses

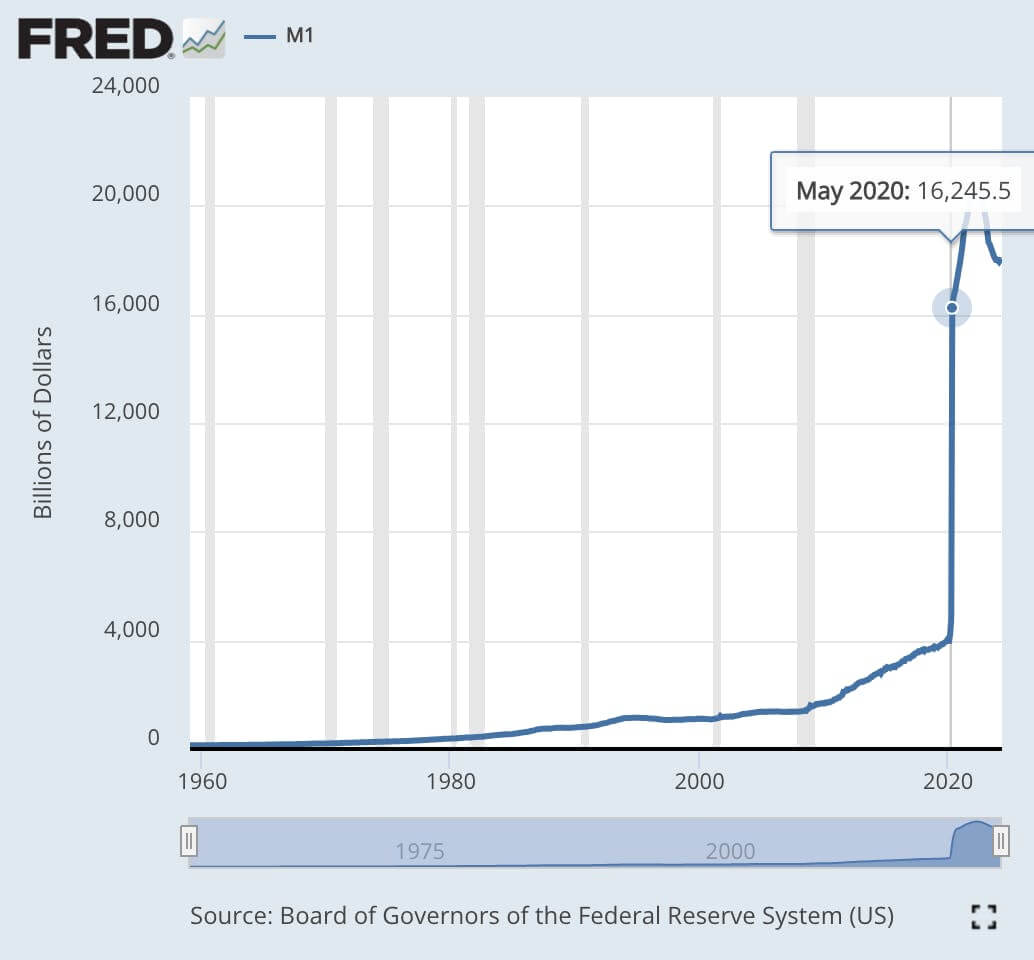

And perhaps most significantly, quantitative easing – which we’ll dissect further in a future article.

But for now, think of quantitative easing as another form of money printing.

In fact, all of the stimulus programs listed above required money printing. Resulting in:

The biggest spike in M1 money supply in history.

So what happens next?

Milton Friedman rolls in his grave.

Inflation Rears Its Ugly Head

Many phenomena can be the cause of inflation.

Printing lots of money is certainly one of them.

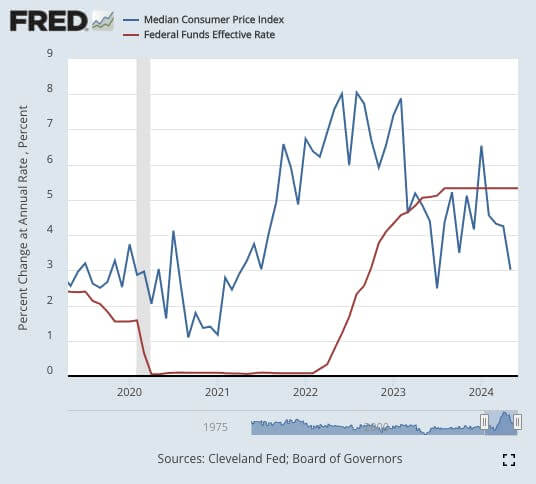

However, this takes time. It usually takes 1-2 years for the effects of fiscal and monetary policy to be felt in the economy through inflation.

(This is as good a time as any to mention that economics is not a science like physics… it is a social science and has many schools of thought. Inflation being caused by money printing is not a mainstream idea, because modern economics is largely aligned with the Keynesian school, whereas this concept comes from the Chicago School and Austrian Schools… More to come on this in future articles.)

This delay is often referred to as the Lag Effect, or Response Lag.

We all experienced it first-hand. Inflation started appearing in late 2021, strengthening into 2022 and beyond.

Prices for everyday items like groceries, gas, and housing started to rise. Slowly at first, then much more rapidly.

Lo and behold, inflation had hit levels not seen in decades.

And once again, the government felt the need to respond.

But this time, through a different government organization…

The Central Bank Tightens in Response

The Central Bank of the United States is also referred to as the Federal Reserve (or, the “Fed”).

And the Federal Reserve has two stated mandates:

- To maximize employment, and

- Maintain stable prices, which to the Fed, means keeping long-term inflation at 2% per year

(Where does this 2% target come from? That’s a topic for another article. And the answer might surprise you!)

Their main tool for bringing down inflation?

Interest rates.

By raising interest rates, borrowing money becomes more expensive for consumers and businesses.

Higher interest rates also slows down risky investing by increasing the risk-free rate i.e. the % return that investors can achieve on their capital “risk-free” by buying US treasuries.

In combination, this effectively slows down or “cools down” the economy. It’s also referred to as quantitative “tightening” (as opposed to quantitative easing).

The Fed has a tough job.

Raise rates too slowly, and inflation will remain persistent.

Raise rates too fast, and it could cause a recession.

And if you’re following so far, you probably see where this is going…

Tech Layoffs Ensue

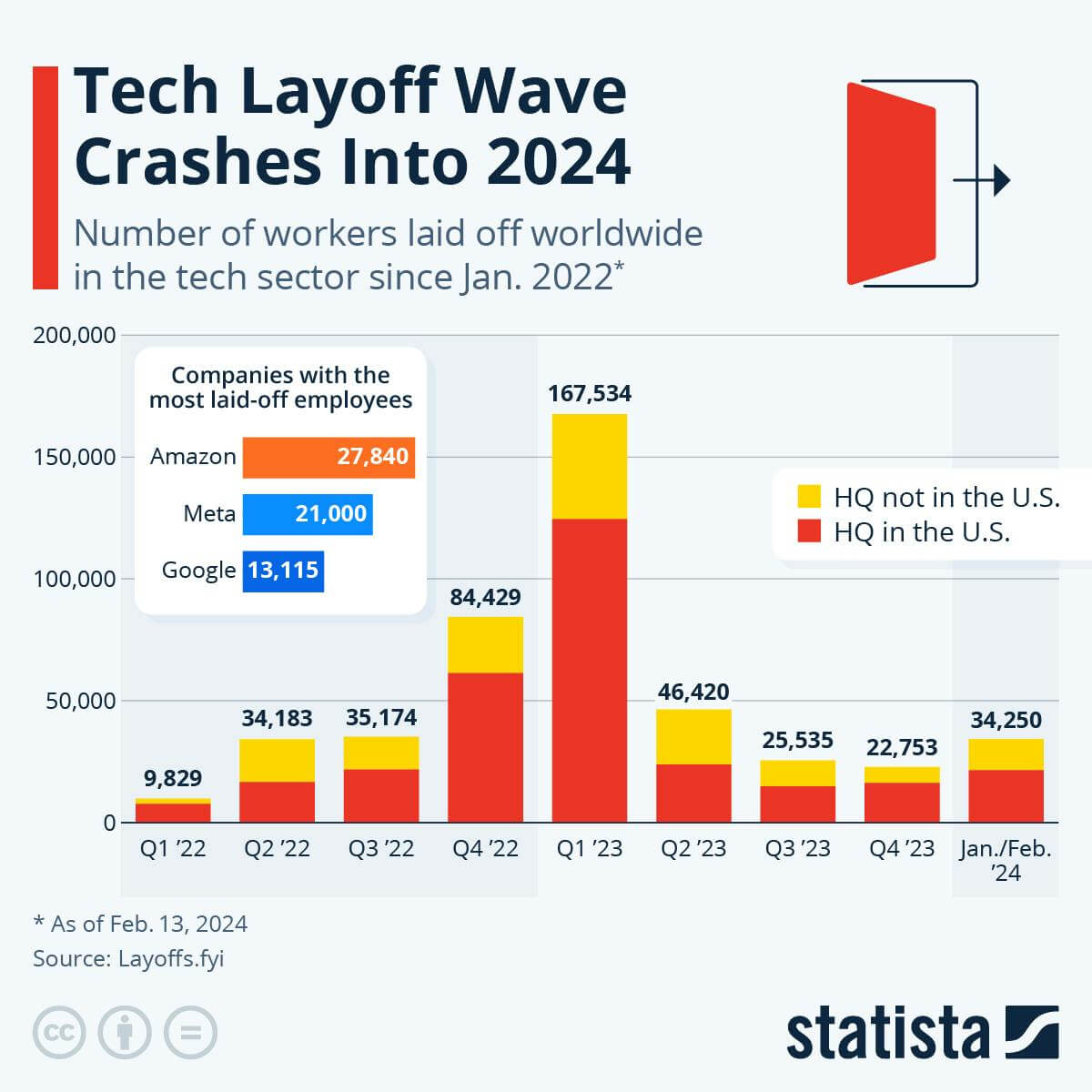

Tech companies are often unprofitable, meaning they are constantly requiring new inflows of capital (or are forecasting for it) in order to continue operating.

Higher interest rates meant investors weren’t willing to take as much risk.

And Venture Capital investing is highly risky.

Less Venture Capital money meant tech companies faced some very hard choices.

Many were left with no choice but to cut costs. And the largest cost for most businesses are employees.

And voila, we have mass layoffs.

Hence, the subject of this week’s article.

Hopefully you’ve found it valuable to see how the dots connect from 2020 all the way to 2024.

And in my opinion, the more people that understand these concepts, the better.

It would mean more people would be better prepared for potential job loss – both financially and mentally. And hopefully, it would mean fewer people’s livelihoods are ruined by something outside our locus of control.

Build in Public Update

Recently I’ve been thinking a lot about my goals for Wealth Potion, and if I’m tracking the right metrics. In large part due to the wonderful 1-on-1 conversations I’m having with friends, mentors, and subscribers.

I am very intentional about building Wealth Potion slowly. I want to remain open and flexible to as many opportunities that might present themselves along the way.

And that means being comfortable with pivoting.

It’s not a huge pivot, but I’ve decided to try something new, starting in July:

- Focus less on Instagram, and more on YouTube (long-form), Twitter / X, and TikTok

- Aim toward monetization on each of these platforms

- Shift my goals away from results and toward output

And so I’ve calculated the monthly impressions (Twitter), views (TikTok) and watch hours (YouTube) I’d need to get monetized on each platform.

While I know that ad earnings won’t be the lion’s share of Wealth Potion’s revenue in the long term, I think it’ll be a fun and motivating short-term challenge to achieve for each platform I’m on.

This week’s YouTube video is all about what I learned in sales, and how mastering sales is a requirement to be successful entrepreneurship. Part 2 dropping this weekend.

Let’s go 💪

To your prosperity, Brandon @ Wealth Potion

Follow Wealth Potion on social media for more exclusive content:

+

If you enjoyed reading, consider forwarding to someone who would find this valuable.

You can read all our previous newsletters here.