August 21, 2023: Panama Canal traffic jam could stoke inflation concerns.

There is currently a huge backlog of 200+ ships waiting to cross the Panama Canal due to drought – ships that are carrying millions of dollars of goods.

The Panama Canal is a critical trade route that allows ships to pass between the Atlantic and Pacific Oceans, without having to go around South America or North America.

But due to extreme weather, notably an unprecedented drought, the Panama Canal is not able to operate at full capacity. This is causing these delays and traffic jams.

Aren’t all the oceans connected? How could drought affect the water levels?

The Panama Canal actually uses fresh water that pours in from 17 surrounding artificial lakes to operate. To make matters worse, the El Nino storm is projected to make the droughts even worse over the coming months, not better.

This backlog of ships will cause an increase in shipping costs for the routes involved, along with further delays.

🪄 How to profit from it:

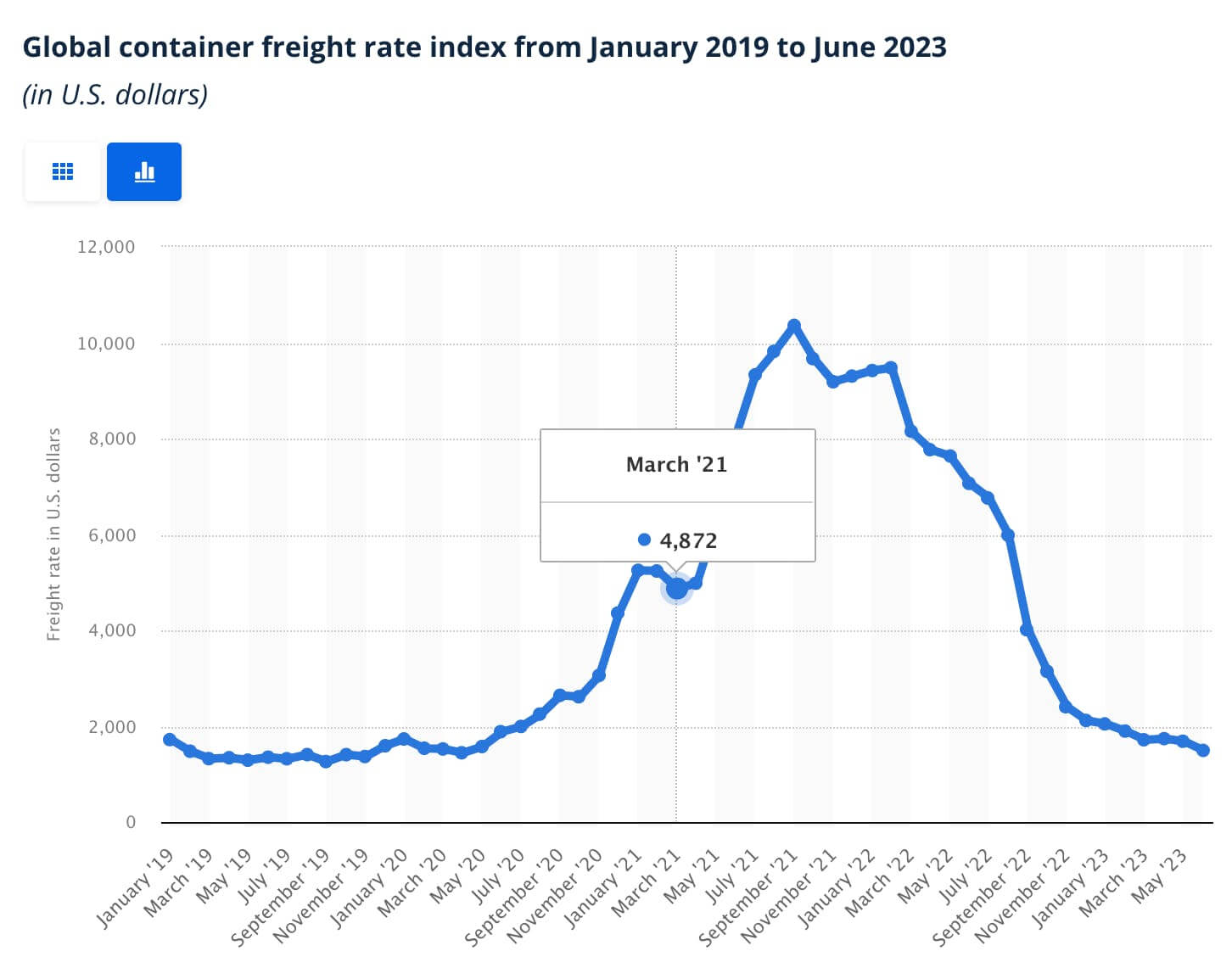

We can look at a similar event for hints as to how the market will react – the Suez Canal obstruction in March 2021.

Of course, there were many other factors at play in 2021, including massive supply chain disruptions due to the pandemic and related lockdowns.

And what does higher shipping costs lead to? Inflation.

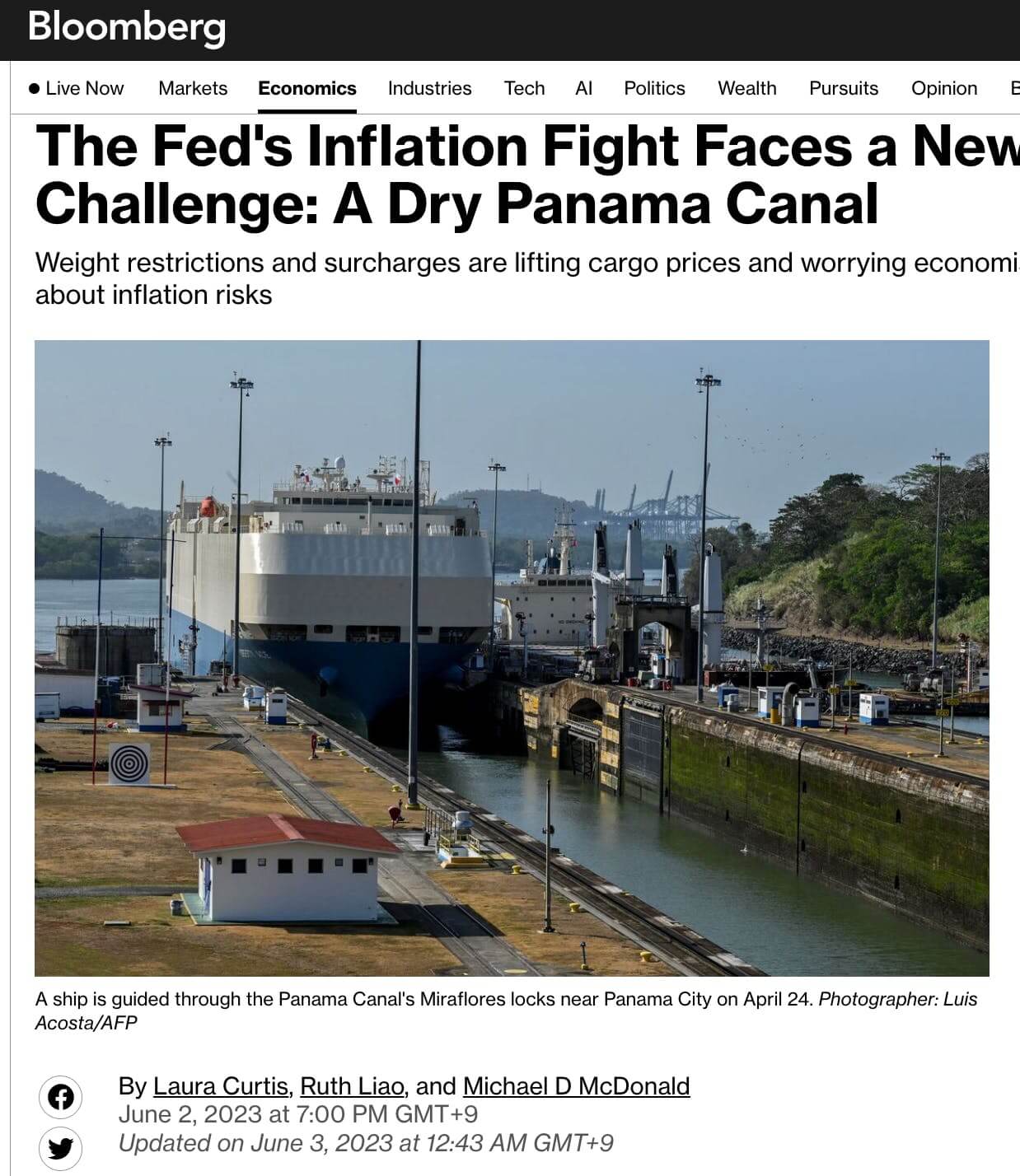

Looking back at today’s issues at the Panama Canal, even Bloomberg reported in June 2023 that this year’s weather could cause inflation issues:

The Wall Street consensus seems to be that inflation has been tamed and that the Fed will be able to cut rates later this year. Here are some questions for you to consider:

- Does this change the Fed’s calculus? What about the market’s expectations?

- If inflation were to stay higher for longer, how would that impact your life?

- How are you changing your investments in light of this news?

To your prosperity,

Wealth Potion