A few weeks ago, we discussed the historical expression of “Burning the Boats”.

Time for another lesson from Ancient History.

The term “Crossing the Rubicon” originates from ancient Rome.

Julius Caesar led his army across the Rubicon River in 49 BCE, violating Roman law and sparking a civil war.

“Crossing the Rubicon” has now become a common expression to signify a point of no return.

A decisive, irreversible action.

The US Dollar as the World’s Reserve Currency

Let’s rewind the clock to 1944.

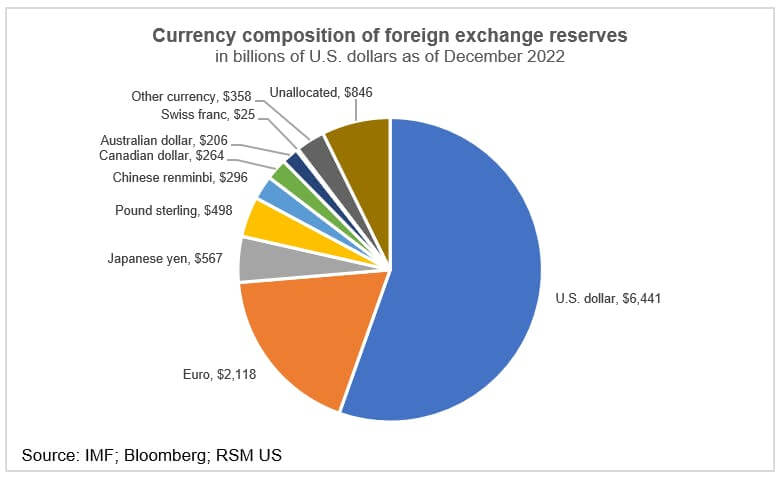

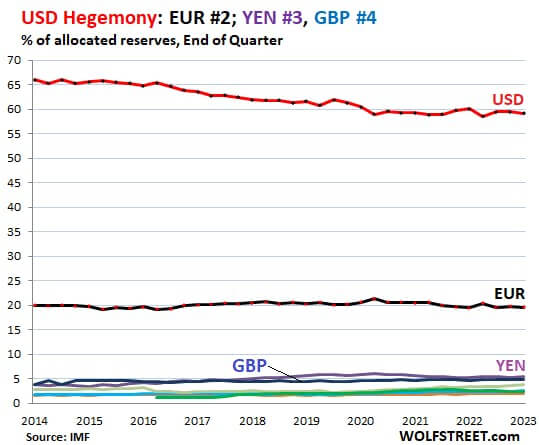

Many of you know that the US dollar is the world’s reserve currency.

This means that governments and institutions around the world hold the vast majority of their foreign reserves in USD.

What you may not know, is that this arrangement was agreed upon in a series of international negotiations that started during World War II.

This led to two periods, commonly referred to as Bretton Woods I and II, named after the conference where these negotiations occurred:

- Bretton Woods I (1944 – 1971): The US dollar was crowned the world’s reserve currency, backed by gold.

- Bretton Woods II (1971 – Today): The US dollar remains the world’s reserve currency, but is no longer redeemable for gold.

Another lesser known fact is that these foreign reserve assets are not always held within the country of the owner.

This will be important later…

This is beyond the scope of today’s article… but if you’ve read this far and you’re left with many questions about the Bretton Woods system, the history of the US dollar, and macroeconomics in general, let us know. What would you like us to dive into next?

Bretton Woods… III?

Fast forward to February 2022.

Russia invades Ukraine.

In response, the US in collaboration with other G-7 Nations freeze Russia’s foreign reserve assets as part of the litany of sanctions against Russia.

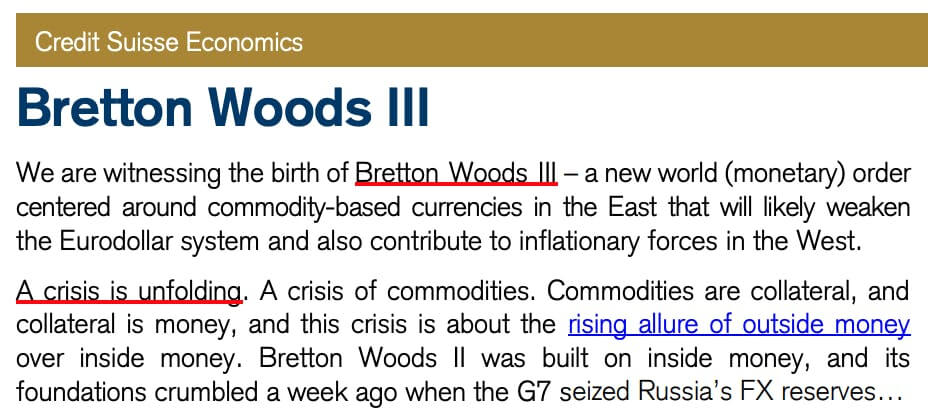

Zoltan Poszar, a highly respected macroeconomic and geopolitical analyst started ringing the alarm bells.

This is by no means a political commentary on the Russia-Ukraine war.

But by freezing Russia’s foreign reserve assets, it set a precedent that Zoltan argues is irreversible.

The message is clear:

Do something against the will of the USD hegemony, and your assets could be frozen.

Now, Zoltan’s predictions have not fully borne out. It’s a dense read, but you can read the full memo here.

Nevertheless, this was the first time in history that the USD used its reserve currency status to punish a geopolitical adversary.

This was Caesar taking the first step into the Rubicon.

The REPO Act

Fast forward to this week.

The US House of Representatives just passed the REPO Act to send an additional $6 billion of aid to help Ukraine.

X (RIP Twitter) is busy debating about the politics of sending aid to Ukraine.

TikTok is up in arms because the “TikTok ban” got slid into this bill, as well.

But not many people are talking about this:

Remember those frozen Russian assets?

The REPO Act would allow the US to give a portion of those frozen assets directly to Ukraine.

To be clear, this bill has yet to be passed by the Senate.

And to repeat: this is not a political commentary.

But this could very well be Caesar’s second step into the Rubicon.

As the infamous Lenin once said, “there are decades where nothing happens, and there are weeks where decades happen.”

Macroeconomics tends to move very slowly.

But some events can ignite such a huge impact that the world changes in ways that can only be seen when looked back upon.

“Why does any of this matter to me?”

There are a few takeaways here that I hope you leave with:

- One of the most important decisions you can make in your life is where you choose to live, build your life, and raise your family. You may not care about macroeconomics, but macroeconomics cares about you.

- Partisan politics is usually a distraction. UBut under the surface, there is usually something more important worth understanding.

- There is no Bretton Woods Conference anymore, and there likely won’t be. But make no mistake – those same people are making decisions that can change the world permanently.

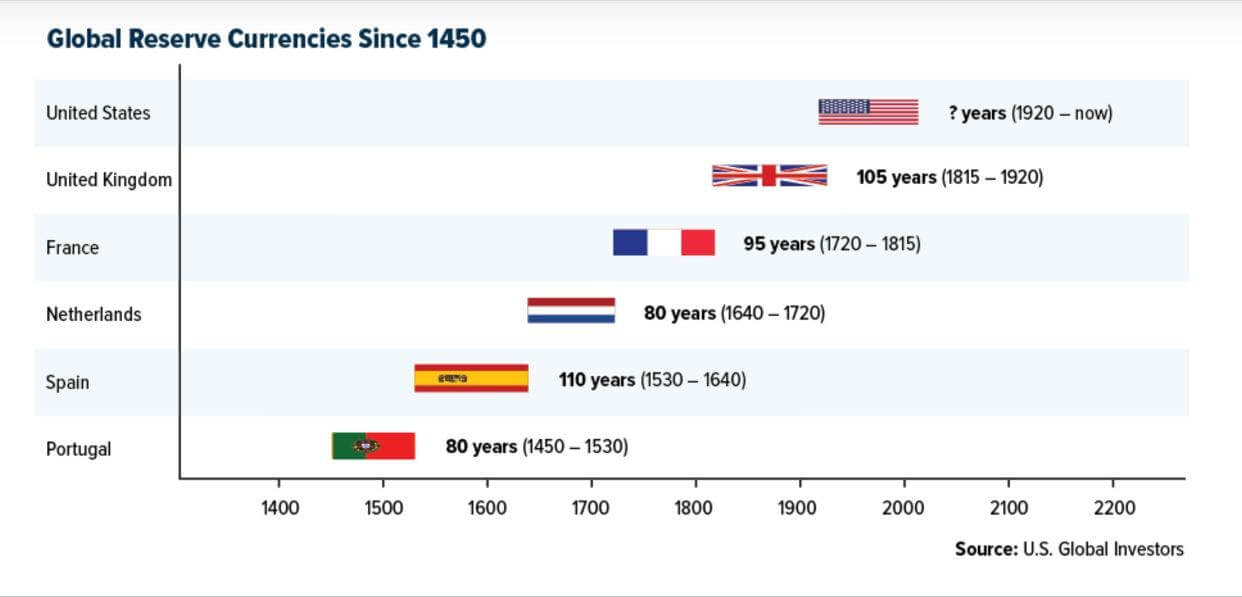

- History doesn’t repeat, but it often rhymes.

And some questions for you to ponder this week:

- How might Russia react if this bill passes the Senate?

- How might China, India, Saudi Arabia, etc. respond to this news?

- How much longer will the USD remain the world’s reserve currency?

- What might the next global reserve currency be?

- What should the next global reserve currency be?

And last but not least, I’ll leave you with this chart, showing the lifespan of world reserve currencies in recent centuries:

To your prosperity, Wealth Potion

Sources:

- https://medium.com/@lindaellisphd/what-is-the-rubicon-and-why-is-it-important-91f715bd86c8

- https://static.bullionstar.com/blogs/uploads/2022/03/Bretton-Woods-III-Zoltan-Pozsar.pdf

- https://en.wikipedia.org/wiki/Bretton_Woods_system

- https://qz.com/2135316/the-g-7-froze-all-of-russias-reserve-assets-in-their-countries

- https://www.nbcnews.com/news/world/house-vote-billions-dollars-russian-government-money-sitting-us-banks-rcna148671

Hat tip to @PauloMacro on Twitter for the “Crossing the Rubicon” inspiration.

Follow Wealth Potion on social media for more exclusive content:

+

If you enjoyed reading, consider forwarding to someone who would find this valuable.

You can read all our previous newsletters here.