Have you ever noticed that the things you buy cost more than they used to?

That’s called inflation.

Inflation is the rate at which prices for goods and services rise (Investopedia). It means that over time, the prices of things go up and you need more money to buy the same stuff.

Or to put it another way: your money becomes worth less, and you need more of it to buy the same things.

Let’s discuss what inflation is, and how you can protect yourself from it.

What is Inflation?

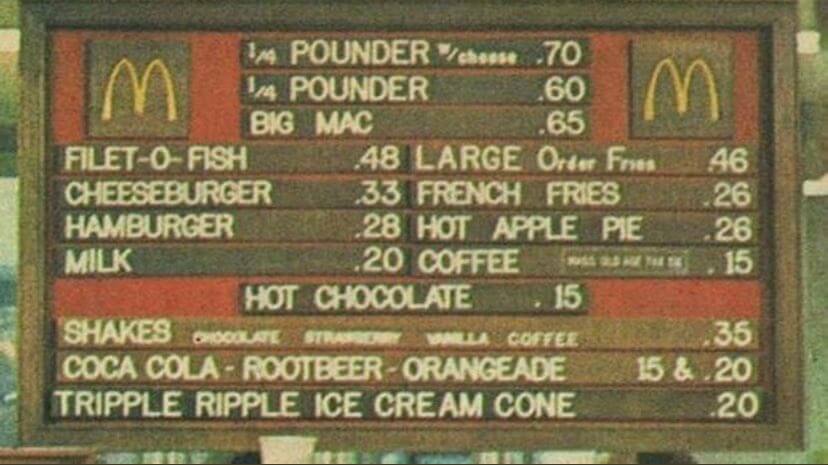

Take a look at the McDonald’s menu above, from 1972.

Today, a McDonald’s hamburger costs $1.69 on average in the United States.

That represents a 503% increase in price from 1972.

That seems like a huge jump, doesn’t it?

But across 50 years, that’s only a 3.22% rate of inflation. Inflation compounds over time, which results in mind-boggling results…

(You can use compounding to your advantage to build your wealth. More to come on the power of compounding… stay subscribed!)

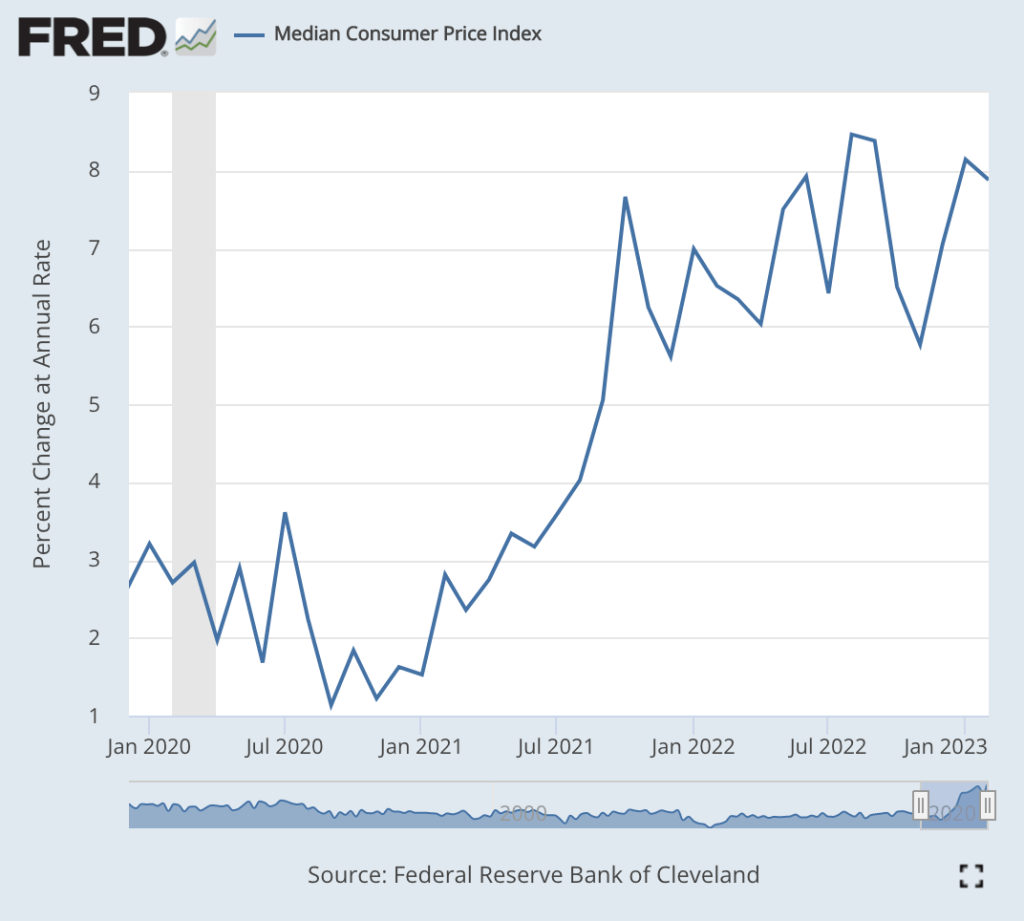

Now imagine what kind of havoc a 7% inflation rate could mean…

How Inflation Affects You

Pop Quiz:

If you go from making $10/hour to $11/hour, then you are making more money, correct?

But if a t-shirt goes from costing $10 to $12… then are you actually making more money?

Answer:

You’re earning more dollars, but your purchasing power hasn’t increased.

Inflation can affect you in many ways… and like Lifestyle Creep, it’s dangerous because it goes unnoticed.

You will feel like you’re making progress when you see more dollars in your bank account… but you’re not actually any wealthier.

So, it’s important to keep an eye on inflation and make sure your income or savings keep up with the rising costs of things.

How to Fight Back Against Inflation

Here are 5 things you can start doing today to protect yourself against inflation.

- Don’t save in cash. Aside from an emergency fund, this is why most investing wisdom says to hold assets, not cash.

- Invest in assets that increase in value. The flip-side of #1. Own equity in a business; hard money like gold, silver and bitcoin, etc.

- Increase your income faster than inflation. If your annual raise is lower than inflation, than you aren’t actually making more money. Think about that….

- Decrease your expenses. Technology has made certain goods fall in price faster than inflation (think electronics like televisions)

- Pay down high-interest debt. Inflation often leads to the Central Bank raising interest rates, which can make your debt more expensive to pay off.

In summary, inflation is not your friend.

Many economists believe that inflation is necessary for our economy to grow.

This is why Central Banks such as the Federal Reserve target an inflation rate of 2%.

But more on that in a future Wealth Potion 😉

Thank you to our early subscribers for supporting this newsletter. If you’re enjoying this content, please consider sharing it with someone you care about.

To your prosperity,

Wealth Potion

Pingback: How "Save Your Money" Became "Invest Your Money" - Wealth Potion