Financial Independence, Retire Early. Also known as FIRE. The FIRE Movement made its first appearance in 1992… but it has exploded in popularity in the past decade among younger generations – especially millennials and Gen Z. Young adults are ready to retire as early as possible. So how much money do you need to save in order to retire?

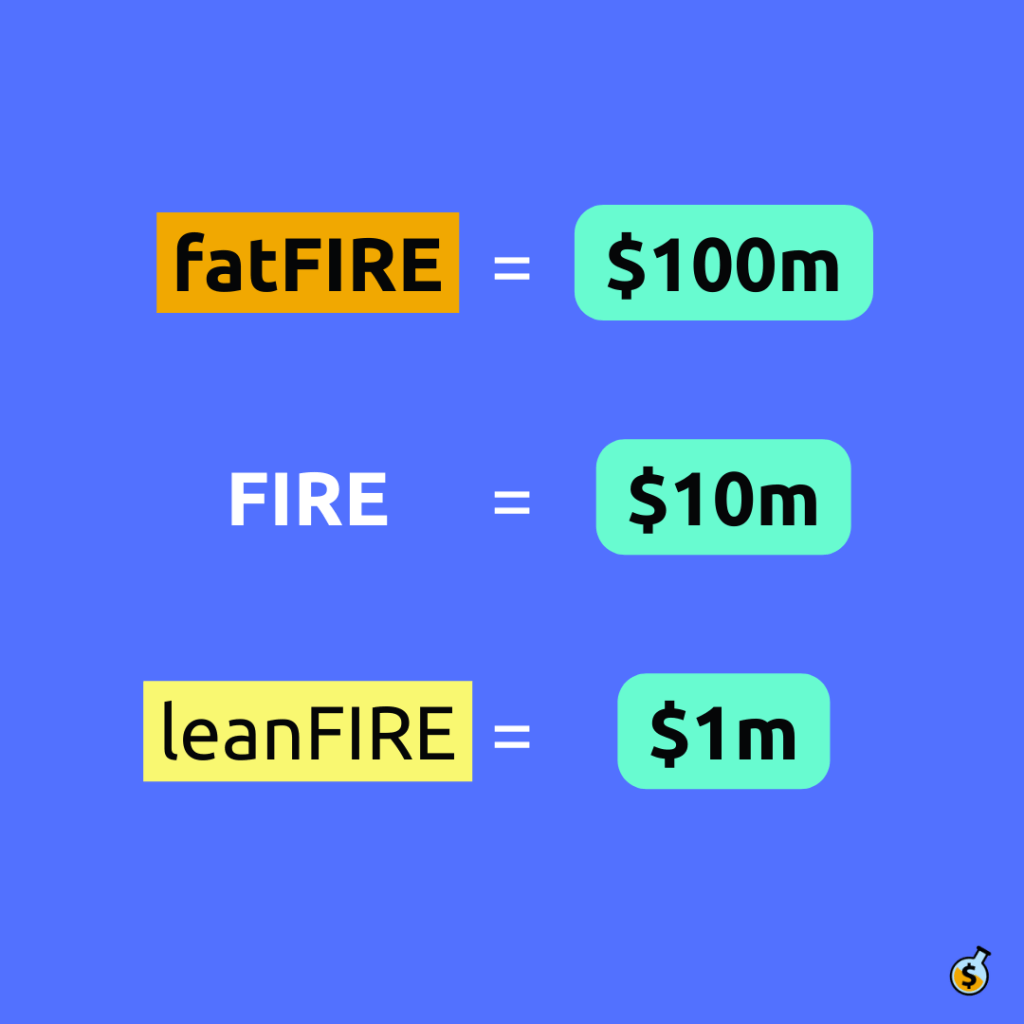

The answer will differ depending on your specific goals for retirement. And to explore this further, we’re going to dive into the worlds of FIRE, leanFIRE, and fatFIRE.

The concept behind the FIRE Movement is quite simple. By increasing your savings rate to 50% – 75%, you can retire much earlier than what society deems “normal” (generally, the age of 65). In fact, by applying the principles of the FIRE Movement diligently and consistently, many people are able to retire in their 40s, 30s, and even in their 20s.

But how much money do you need to save in order to retire early?

The formula for retiring early is actually quite simple. Let’s do some math:

✅ If you take the avg. household expenses in developed nations

✅ Assume a moderate 3-4% withdrawal rate

✅ Adjust for taxes, etc.

With the above method, you will arrive at a savings target between $5 million and $10 million. You can also calculate your own personal savings target by using real figures based on your income, expenses, tax rate, ideal withdrawal rate, etc. It’s safe to say that with a nest egg of $10 million, you can *easily* achieve FIRE.

But can you retire early without hitting the $10m mark?

Absolutely.

leanFIRE on Reddit – Retiring Frugally

leanFIRE is all about retiring as early as possible. It follows the same methodology as FIRE (reduce expenses, increase savings rate, and retire early) but with a focus on extreme frugality.

By keeping your household expenses to less than $50,000 annually (or $25,000 per individual), you can retire with as little as $1,000,000 in savings. At first glance, living off of $25,000 per year might seem straightforward. But in fact, it’s quite difficult.

Consider the fact that rent alone in most HCOL (high cost of living) cities often costs $24000 to $36000 per year. Right off the bat, leanFIRE eliminates the ability to live in VHCOL cities like New York, San Francisco, or Los Angeles.

For more information about leanFIRE, and to join a community of savers looking to retire early through the leanFIRE method, check out the /r/leanFIRE subreddit on Reddit. Here’s what we learned:

Lessons from the leanFIRE Reddit

By reading through the leanFIRE reddit, you’ll notice that most posts focus on tips and tricks to save as much money as possible. This is because leanFIRE is very focused on reducing one’s expenses.

Some of the common topics include:

✅ Moving to a lower-cost city, or smaller home

✅ Saving money on subscriptions

✅ Budgeting in extreme detail

✅ Cooking, walking, biking

✅ Minimizing debt

In short, leanFIRE emphasizes cutting back on one’s expenses in order to achieve financial freedom.

Are you willing to be extremely frugal in order to retire early? Why or why not?

If not, stay tuned. Next, we’ll be breaking down fatFIRE – the complete opposite of leanFIRE.

fatFIRE on Reddit – Retiring Lavishly

fatFIRE is the spiritual opposite of leanFIRE. Instead of achieving early retirement through extreme frugality, fatFIRE aims to retire with a very high cost of living.

In other words, fatFIRE is all about retiring extremely wealthy.

There is no exact definition of fatFIRE, nor is there a specific dollar figure that qualifies as fatFIRE. But as the name suggests, the idea is to retire with a fat stash of cash. Instead of breaking down your expenses, you start with the end in mind. Most people seeking fatFIRE aim to retire with a lifestyle that has no restrictions:

✅ What’s on your bucket list?

✅ Where do you want to live and travel?

✅ What luxury possessions do you want to own?

✅ What have you always dreamed of experiencing?

fatFIRE places to limits to these possibilities. If you have a long bucket list of things you want to do before you die, fatFIRE may be for you. However, it is not for the faint of heart. In order to achieve fatFIRE, one must save the most of all methods.

If FIRE requires a net worth of approximately $10,000,000 and leanFIRE requires a net worth of approximately $1,000,000 – fatFIRE could be defined as retiring with a net worth of approximately $100,000,000. Yes, that’s right: one hundred million dollars.

Lessons From the fatFIRE Reddit

By reading through the most popular stories and experiences on the Reddit community /r/fatFIRE, a pattern emerges. Most people who achieve fatFIRE do so by starting a successful business, and then selling that business.

This is not the only way to achieve fatFIRE, but it certainly is one of the most achievable. Building a business that you own equity in is one of the most sure-fire ways to build long-term wealth.

Which of the FIRE methodologies resonates most with you? Are you aiming for a pretty standard life style for your family? Are you willing to sacrifice more of your lifestyle so that you can retire as early as possible? Or is your goal to achieve an extremely high level of wealth so that you can retire in luxury?

Wealth Potion is all about helping you build lasting wealth for your future selves – whether you’re seeking FIRE, leanFIRE, or fatFIRE. Follow us on social media, or subscribe to our newsletter to never miss an update.

Pingback: What is FatFIRE and How Much to FatFIRE - Wealth Potion

Pingback: Personalized Finance - Wealth Potion

Pingback: Making Money vs. Keeping Money - Wealth Potion