Technological Miracle vs. Online Casino

Many people are confused when I tell them that I’m into Bitcoin… but I’m not into crypto.

Isn’t Bitcoin a cryptocurrency?

Yes, it is. But Bitcoin and what most people refer to as “crypto” are fundamentally opposed to one another.

It’s not even that I believe Bitcoin is the most valuable cryptocurrency…

I believe Bitcoin is likely the only cryptocurrency that has value, and that the rest of the crypto space is mostly scams.

Today, I’m going to try my best to answer:

- What Bitcoin is

- Why Bitcoin is valuable

- What Crypto is

- Why Crypto is not valuable (with exceptions)

Or at least, my opinion on each of the above topics.

Strap in, this one might get controversial. Or watch here:

What is Bitcoin?

On October 31st 2008, Satoshi Nakamoto published the Bitcoin Whitepaper. It’s a 9 page document that outlines a completely novel approach to digital money.

In other words, Satoshi invented peer-to-peer electronic cash.

Wait, isn’t our money already digital? I send money online all the time.

Technically, yes. However, when you send money online you are relying on a middleman (or multiple middlemen).

In other words, you are already using an electronic cash system, but it’s not peer-to-peer.

So what happens when you send someone money via your bank, Venmo, Interac eTransfer, and so on?

If you send me money, some third party maintains a ledger that says “deduct x dollars from your account” and “add x dollars to Brandon’s account”.

Bitcoin does this in a peer-to-peer fashion instead.

Or, to put it another way, Bitcoin allows this to happen without a centralized third-party.

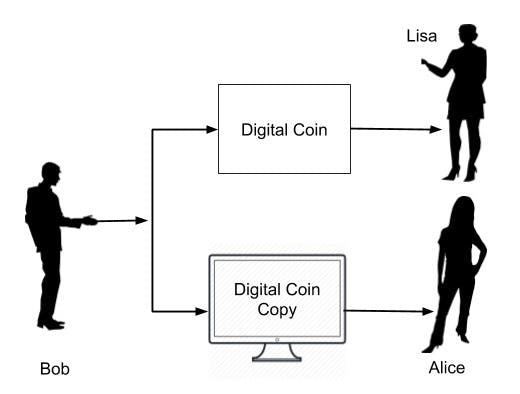

I won’t be digging into too much of the technical details of Bitcoin today, but the very simple explanation is that Bitcoin solves whats called the “double spend problem”.

The challenge with digital goods is that new copies are created all the time.

Imagine I send you a photo by attaching a .jpg file to an email.

I “sent” you the photo, but now we both have the photo! If the photo were an asset, we just duplicated the asset.

Bitcoin solves this problem without trusting a third-party.

It’s also important to note that prior to October 2008, this problem had never been solved before.

There had been many attempts at a digital currency by cryptographers, going back decades. HashCash, Bit Gold, eCash, B-Money…

But none of them worked without requiring users to trust a third party.

Now, there’s one more important aspect of Bitcoin for today’s discussion, which is its fixed supply issuance.

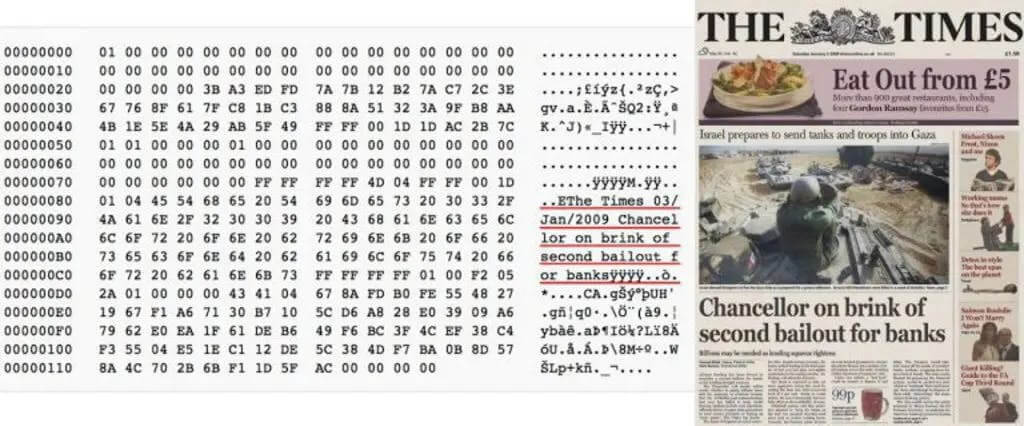

On January 3rd 2009, just 3 months after publishing the whitepaper and having discussions with fellow cypherpunks via online forums, Satoshi launched the Bitcoin blockchain.

This was also the same day that the British government announced further bailouts for the banks following the 2008 financial crisis.

Satoshi hid a secret message in the first block on the Bitcoin blockchain (also called the Genesis Block), which was the headline of The London Times that same day.

This timing was not a coincidence.

You see, Satoshi didn’t just create Bitcoin “for funsies”.

Satoshi viewed fiat money (government-issued money) as broken.

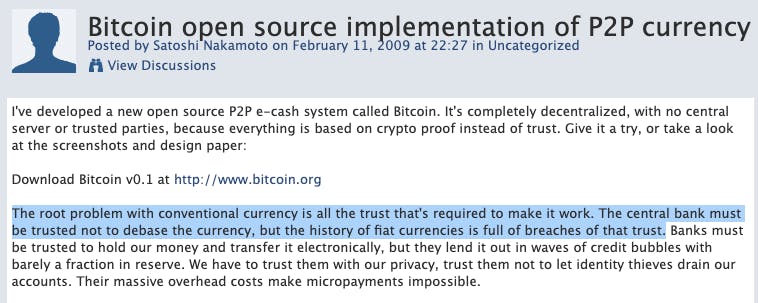

While Satoshi never explicitly stated their economic philosophy in detail, we have plenty of emails and forum posts where they discussed the implementation of Bitcoin with other cryptographers in its early days, and announced it to other P2P communities.

Perhaps the most insightful post is his announcement on the P2P Foundation discussion forums in February 2009.

How did Satoshi accomplish this?

Satoshi programmed a hard cap on the number of Bitcoin that will ever exist. There will never be more than 21 million Bitcoin.

That way, no government, no bank, and no individual can debase your Bitcoin by creating more than what has been programmed.

There is so much more to cover here… and I’m sure you have questions. If you’re interested in this topic, please let me know and I’ll certainly write more articles and record more videos on this in the future.

Alright, let’s recap:

Bitcoin solves a technical problem – the double spend problem.

Bitcoin solves a real world problem – fiat money being debased by government money printing.

Okay… then what is “crypto”?

What is Crypto?

Bitcoin is what is referred to as a cryptocurrency, largely because the people working on Bitcoin alongside Satoshi Nakamoto were experts in cryptography.

In order for Bitcoin to allow anyone to validate transactions without relying on a third-party, it had to be fully transparent. And for code to be fully transparent, it has to be open source.

And when code is open source… well, people can copy it.

And that’s exactly what happened.

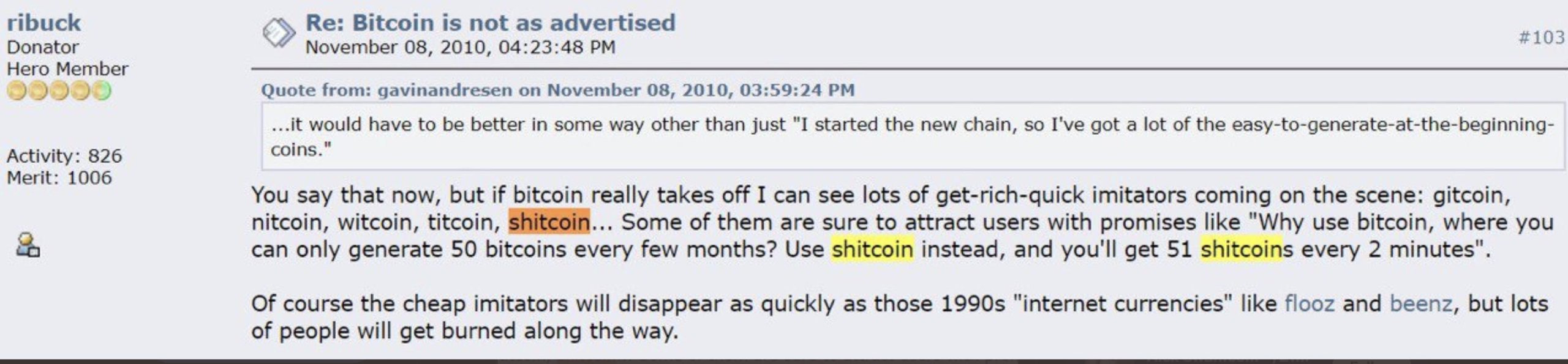

People copied from the core concept of Bitcoin and created alternative currencies, more colloquially referred to as altcoins (or more derogatorily, sh*tcoins).

This created a whole new ecosystem which most people refer to as “Crypto”.

The claim is that these other cryptocurrencies aren’t exact copies of Bitcoin, but that they improve on Bitcoin’s design.

Perhaps they validate transactions faster. Perhaps each block in the blockchain can hold more transactions. Perhaps they allow for entirely new functionality, such as smart contracts.

Isn’t that a good thing? Why wouldn’t these newer versions of Bitcoin be valuable?

Why Bitcoin has value and Crypto does not

Everything I’ve written above is objective. Now, we need to get a bit subjective…

Bitcoin exists to solve a technical problem (double spend problem) and a real world problem (debasement).

There are two main problems with the rest of “Crypto”:

- They are early-stage startups with extremely high valuations

- They are not truly decentralized

Alternative cryptocurrencies claim to have “improved” some element of Bitcoin, but they are largely solutions looking for a problem to solve.

To be clear, there’s nothing wrong with trying to create new technology.

But I would be extremely cautious of thinking about Bitcoin and Crypto in the same way.

Bitcoin is a new form of money.

Crypto projects are more like… early-stage technology startups. And they don’t have product-market fit.

And that’s just fine. Until you consider:

- There are over 13,000 alternative cryptocurrencies as of March 2024

- Most alternative cryptocurrencies do not have product-market fit

- Most alternative cryptocurrencies have extremely rich valuations

Can you get extremely wealthy through angel investing? Seed-stage startup investing? Absolutely.

However, angel investors know better than anyone – the vast majority of angel investments go to zero.

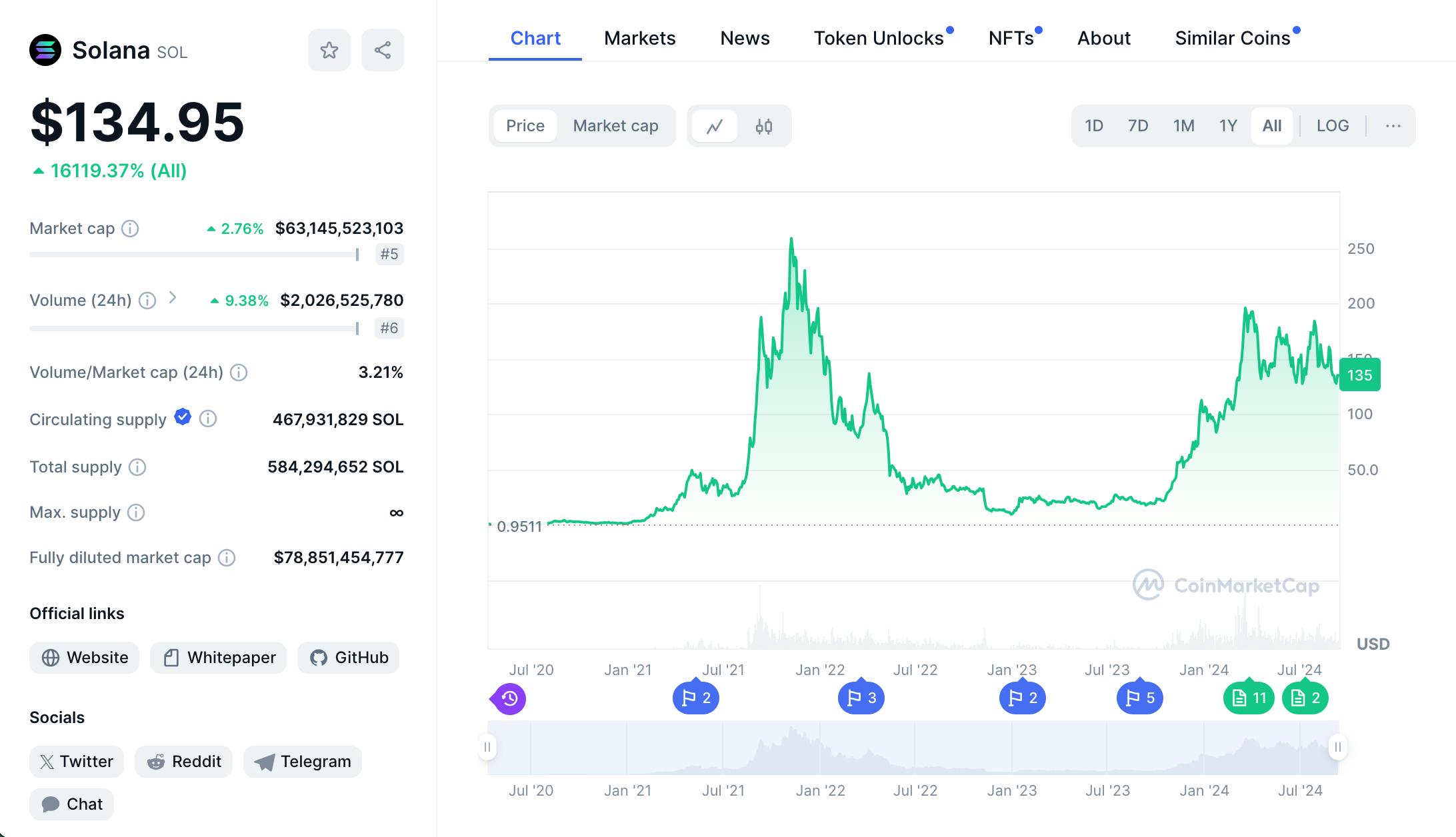

I will use Solana as an example:

Can you get wealthy investing in Solana? Absolutely. Many have.

Does Solana have product-market fit? Questionable at best. The majority of it’s use case is for memecoins and gambling.

Is Solana a prudent investment at a $63 billion market cap? I don’t know about you, but that valuation seems rich to me.

Alright, now let’s say you still want to invest in Solana. Perhaps you think Solana can reach a $100bn market cap or more!

There’s one question left to answer. Is Solana decentralized?

There are many ways to look at decentralization. Let’s look at two.

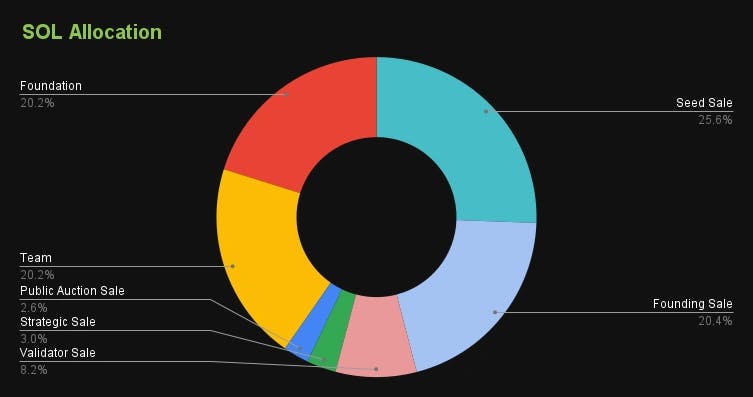

First, let’s look at the initial token allocation.

In other words, when Solana was created:

- 20.2% of tokens went to the Solana “Foundation”

- 20.2% of tokens went to the Solana “team”

- And between the Seed Sale and Founding Sale, it’s estimated that ~30% of the tokens are held by VC firms

That doesn’t sound very decentralized to me.

This also brings up the 2nd way to look at decentralization.

What exactly do they mean by “Foundation” and “team”?

Many alternative cryptocurrencies have a Foundation – a non-profit entity that exists to further development of the protocol by funding projects, startups, developers, and so on.

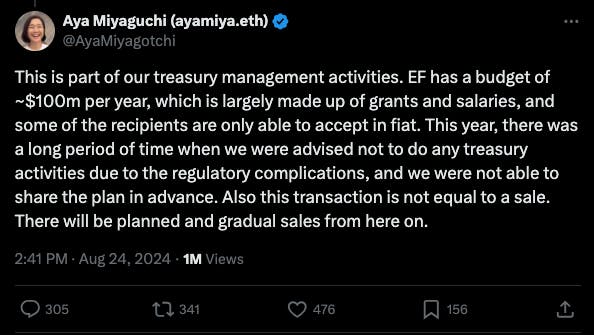

In fact, this sparked a controversy recently in the Ethereum community, when it was revealed that the Ethereum Foundation spends $100 million USD per year supporting the ecosystem.

Meanwhile, Bitcoin has no Foundation. No Team. No $100 million budget to spend.

Bitcoin does have developers – open-source devs who volunteer their time to fix bugs, update the code based, and so on.

And these Bitcoin developers are supported by independent grants by third-party organizations.

This last section got into some weeds, so let’s recap:

- Bitcoin solved the double spend problem and exists to solve government debasement of money

- Crypto copied some or all of Bitcoin to create, in effect, technology startups

- These technology startups do not have product-market fit, yet they have extremely richh valuations

- Valuations aside, these crypto projects claim to be decentralized, but they are not

This was a longer issue, and I appreciate your patience.

As you can tell, I’m very passionate about this topic.

I’ve literally spend hundreds of hours studying this stuff, and perhaps I’ll share my personal story of how I became a Bitcoiner (AKA took the “orange pill”) some other time.

If you have any feedback or questions, I’d love to hear from you.

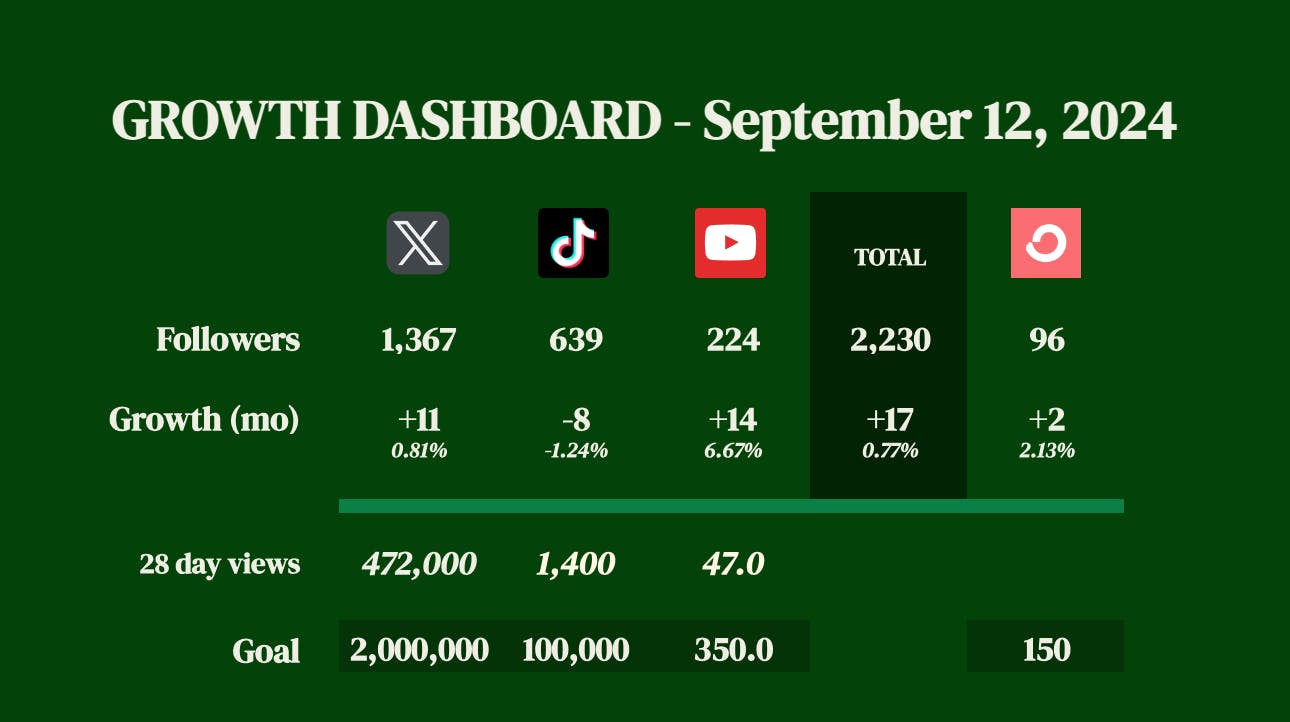

Build in Public Update

Appreciate your patience these past few weeks. This week’s topic is an important one to me, and I wanted to get it right. It got me thinking a lot about prioritizing quality over quantity:

- I set myself a goal to write one newsletter article and publish one YouTube video per week. This was an arbitrary goal.

- Trying to meet this goal, I found myself slowly but surely choosing topics that I could research and write about quickly. I was unintentionally prioritizing quantity over quality.

- While I believe quantity is also important, especially for new Creators, I don’t want it to limit me from tackling topics that I believe are important for financial literacy and building wealth.

What do you think? As always, I’m open to you feedback.

Until next week.

To your prosperity,

Brandon @ Wealth Potion

Follow Wealth Potion on social media for more exclusive content.

If you enjoyed reading, consider forwarding to someone who would find this valuable.

You can read all our previous newsletters here.