Last week, we simplified the concept of inflation using Inflation Island, an imaginary two-person economy.

To recap, inflation is what happens when too much money chases too few goods. Whether we are measuring inflation in a 2-person island, or in the global modern economy, the mechanism remains the same.

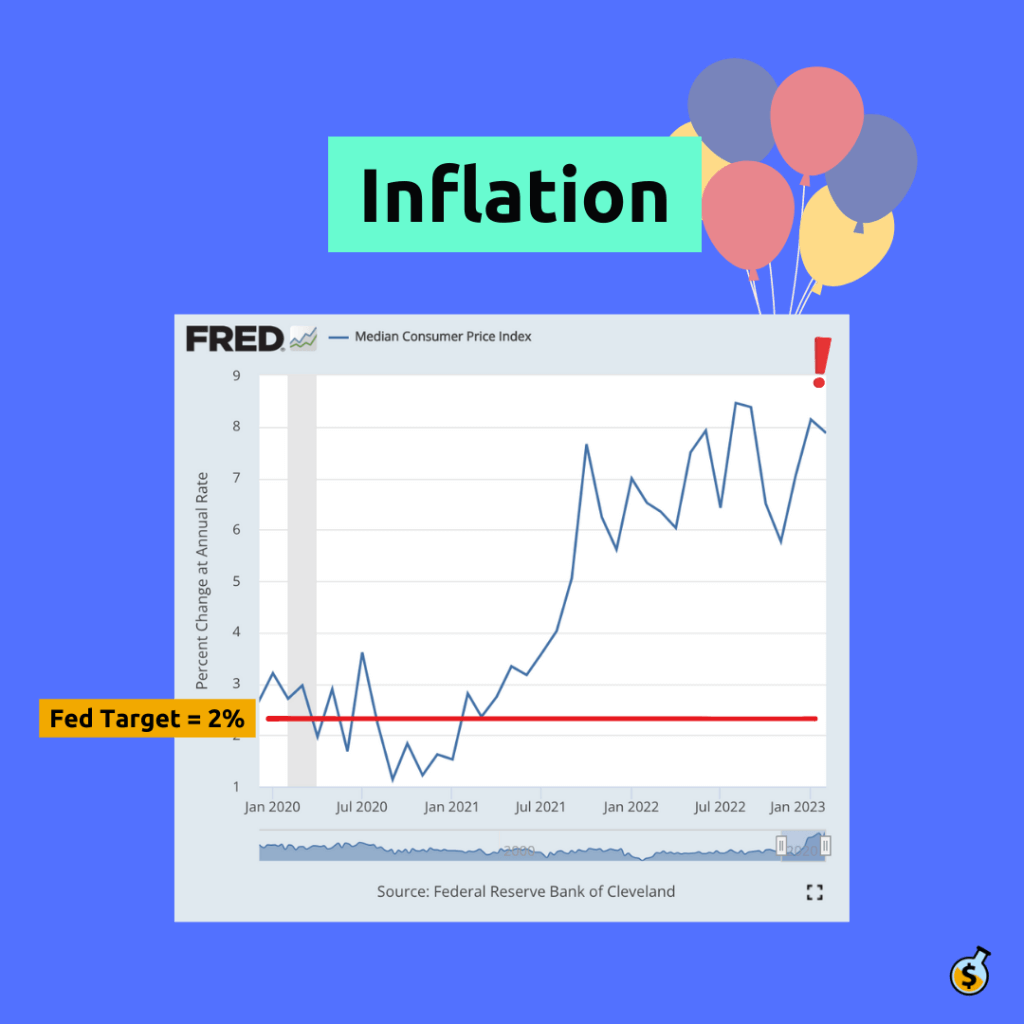

Now, let’s examine the economy between 2020 and 2023 and see if we can figure out what caused inflation.

But first, we must first understand how the quantity of money is measured in the modern economy. We need to look at the money supply.

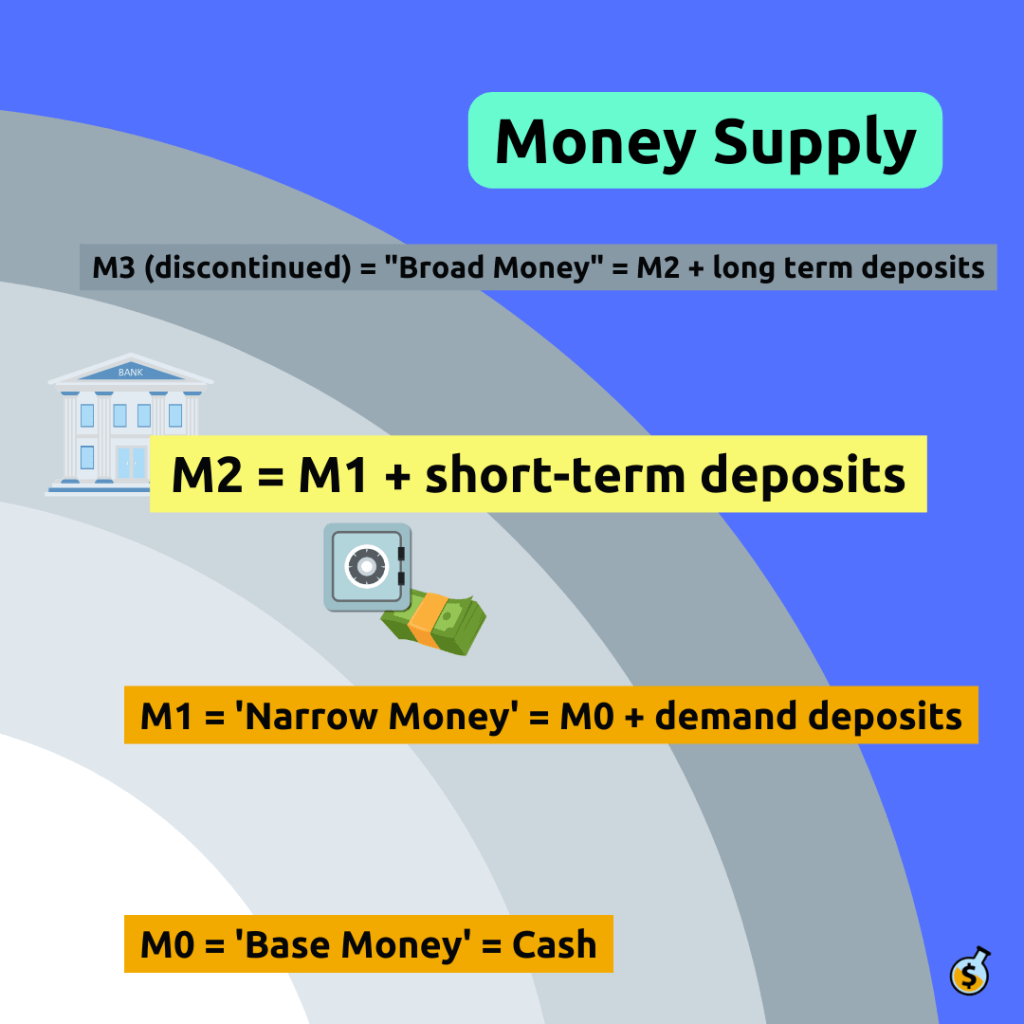

What is Money Supply?

“Too much money” implies something important. It implies that the quantity of money in the economy is not fixed, and actually changes over time – just like the imaginary island scenario. This quantity of money in the economy is called money supply.

However, money is created and destroyed in many different ways, and so there are many ways to measure it. Think of money supply like a series of concentric circles. Put simply:

M0 = “Base Money” = Cash in circulation

M1 = “Narrow Money” = M0 + demand deposits (easily convertible to cash)

M2 = M1 + short-term deposits

M3 (discontinued) = “Broad Money” = M2 + long term deposits

When using money supply for the purposes of examining inflation, most economists look at M2, because it includes short-term deposits which could easily be turned into cash, and therefore, influence the amount of money in circulation.

What Caused Inflation between 2020 and 2023?

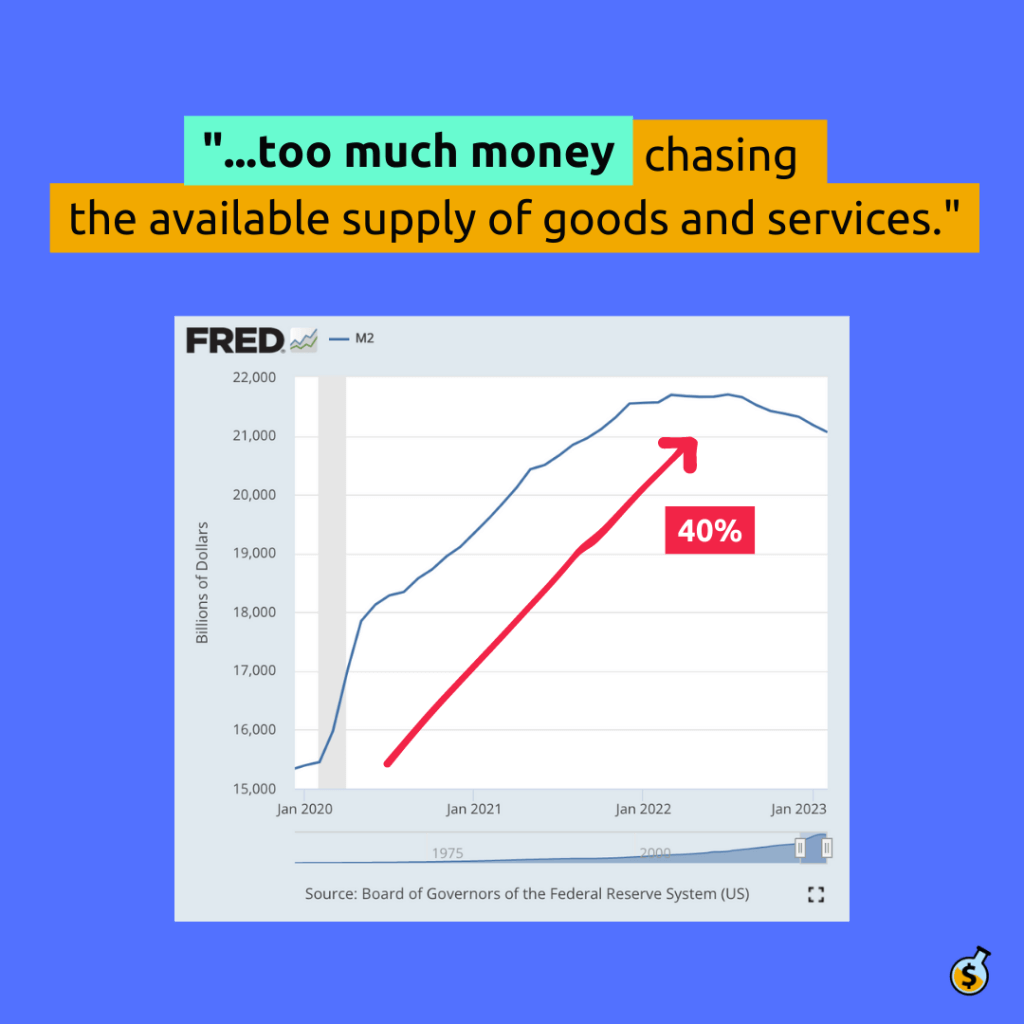

An expansion of the money supply means that the quantity of money has increased. Whereas a contraction of the money supply means that the quantity of money has decreased.

If we look at M2 money supply from 2020 to 2023, we can see a clear expansion of the money supply.

Since March 2020, the United States M2 money supply has grown by 40%.

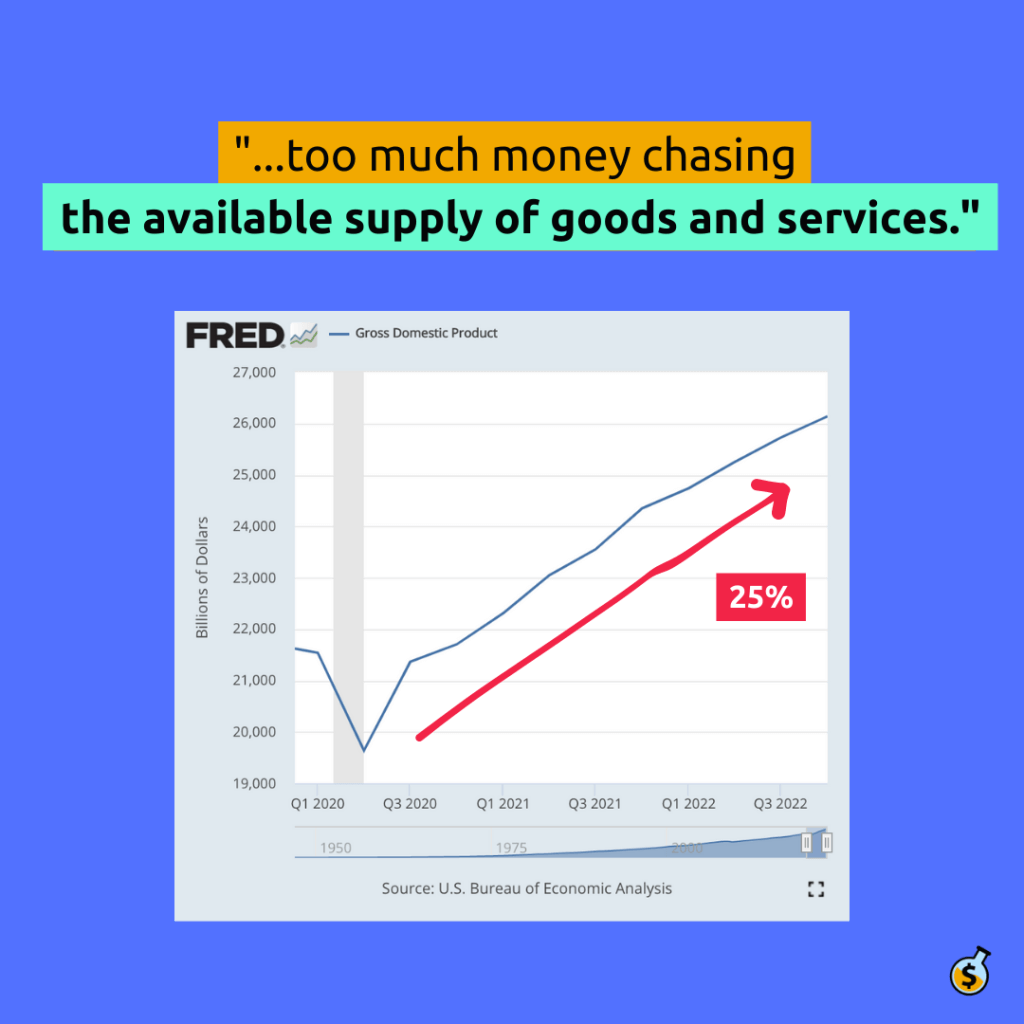

Again, inflation is when too much money chases too few goods. So how do we measure goods? One such measure if Gross Domestic Product, or GDP. GDP measures the dollar value of all good produced in the country.

And if we look at the same time period between 2020 and 2023, US GDP has grown by 25%.

In other words, there are 40% more dollars and only 25% more goods.

And what happens when you have too much money chasing too few goods? You guessed it. Inflation.

As Milton Friedman put it, “Inflation is, and always is, a monetary phenomenon.” This is because while everyone has the power to impact the GDP by producing more or less goods, the central bank has a direct influence on the money supply.

If this topic is interesting to you, let us know and we’ll write more about inflation in the future. There’s a lot to unpack around the challenges with inflation vs. deflation, why the Federal Reserve has a 2% target for inflation, and what our inflationary system means for the global economy (hint: it requires infinite growth…).

To your prosperity,

Wealth Potion

PS. The Federal Reserve Bank of St. Louis publishes all of these metrics for free. Investors who understand these metrics, were not surprised by inflation. Understand these metrics, and you too can see around the curve. If you have the time, we highly recommend exploring the site and studying the source data.

Pingback: The Creator Economy is the Future - Wealth Potion

Pingback: Tech Layoffs Weren't Your Fault - Wealth Potion