Do you ever feel like no matter how much money you make, you’re always living paycheck to paycheck?

If so, you might be experiencing lifestyle creep.

It’s a dangerous situation because it can go unnoticed for a long period of time.

But slowly… secretly… it’s destroying any hope of you achieving your long-term financial goals.

What is Lifestyle Creep?

Lifestyle creep is the gradual increase in spending as your income increases.

As you make more money, you spend more money.

You get that big raise at work, but then you buy a new car.

You get a new job that pays better, but then you buy that new house.

And this is extremely common. Lifestyle creep can be dangerous because it can lead to difficulty saving money, debt, limited financial flexibility, and increased stress and anxiety.

In other words, lifestyle creep causes you to forego your long-term goals, for short-term benefits.

An Example of Lifestyle Creep

Let’s illustrate lifestyle creep using an example.

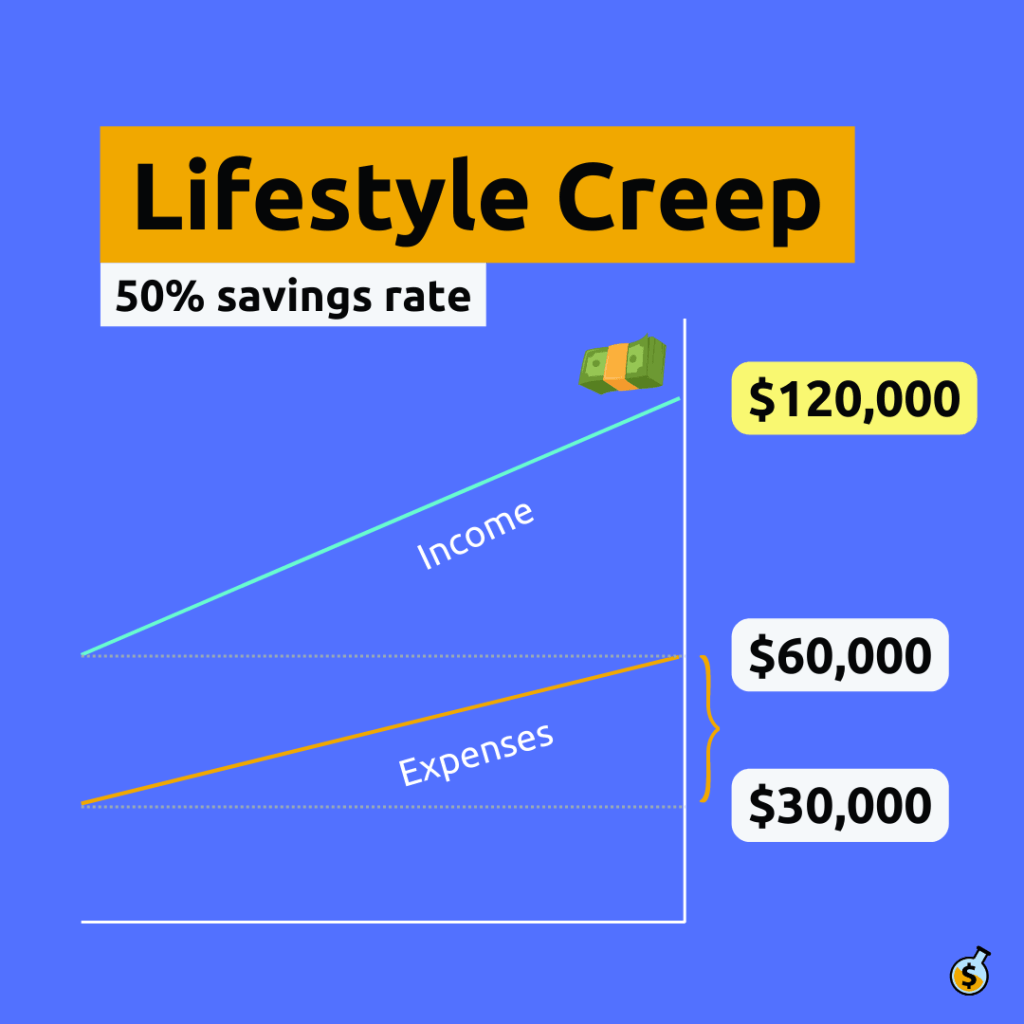

Let’s say your salary was $60,000 and you find a new job that pays you $120,000. Your income doubles.

(This is an extreme increase in salary, but this will make the math easier and more clear.)

Let’s also say that you used to spend 50% – or $30,000 of your $60,000 salary.

What tends to happen when people experience an increase in their income, is their expenses grow in proportion.

This would mean that even though you’re now earning $120,000, you’re now spending $60,000.

You’re still spending 50% of your income.

And although you might think this is okay, because you’re saving $60,000 versus $30,000…

You’re still only saving 50% of your income.

How to Avoid Lifestyle Creep

But there are ways to avoid lifestyle creep and maintain financial stability. Here are three tips to help you stay on track:

- Create a budget and stick to it. No one enjoys making budgets, but it is a useful tool to ensure your spendings doesn’t exceed certain limits you set for yourself.

- Set savings goals. When you have a clear goal in mind, it can help you resist the temptation to spend more on discretionary items.

- Keep your long term goals in mind. By reminding yourself of your long-term goals, you are able to think more clearly when you’re faced with the temptation to spend your money.

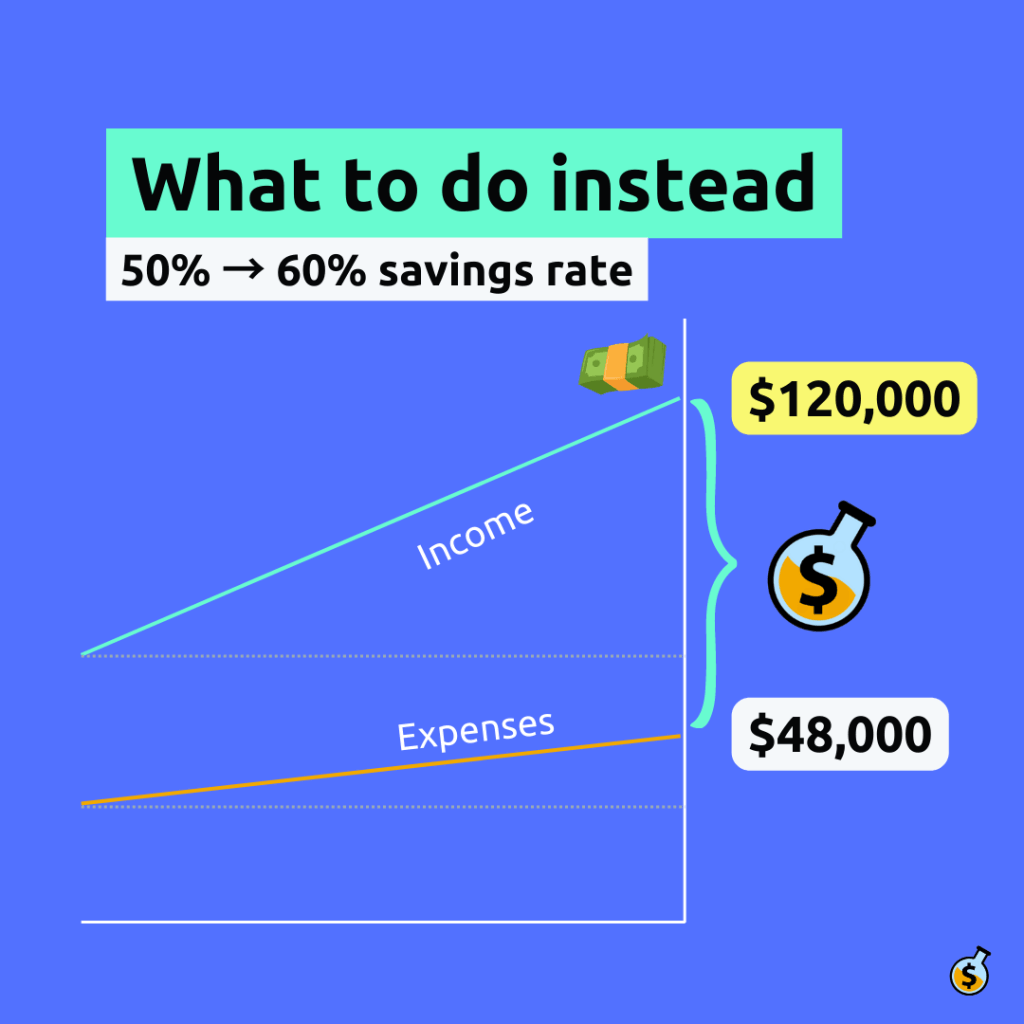

Back to our example, let’s imagine that by sticking to a budget, setting savings goals, and keeping in mind your long-term goals, you’re now only spending $48,000 of your $120,000 salary.

Now, you’re saving 60% of your income, instead of 50%.

This might not seem like a big difference.

So why is this so important?

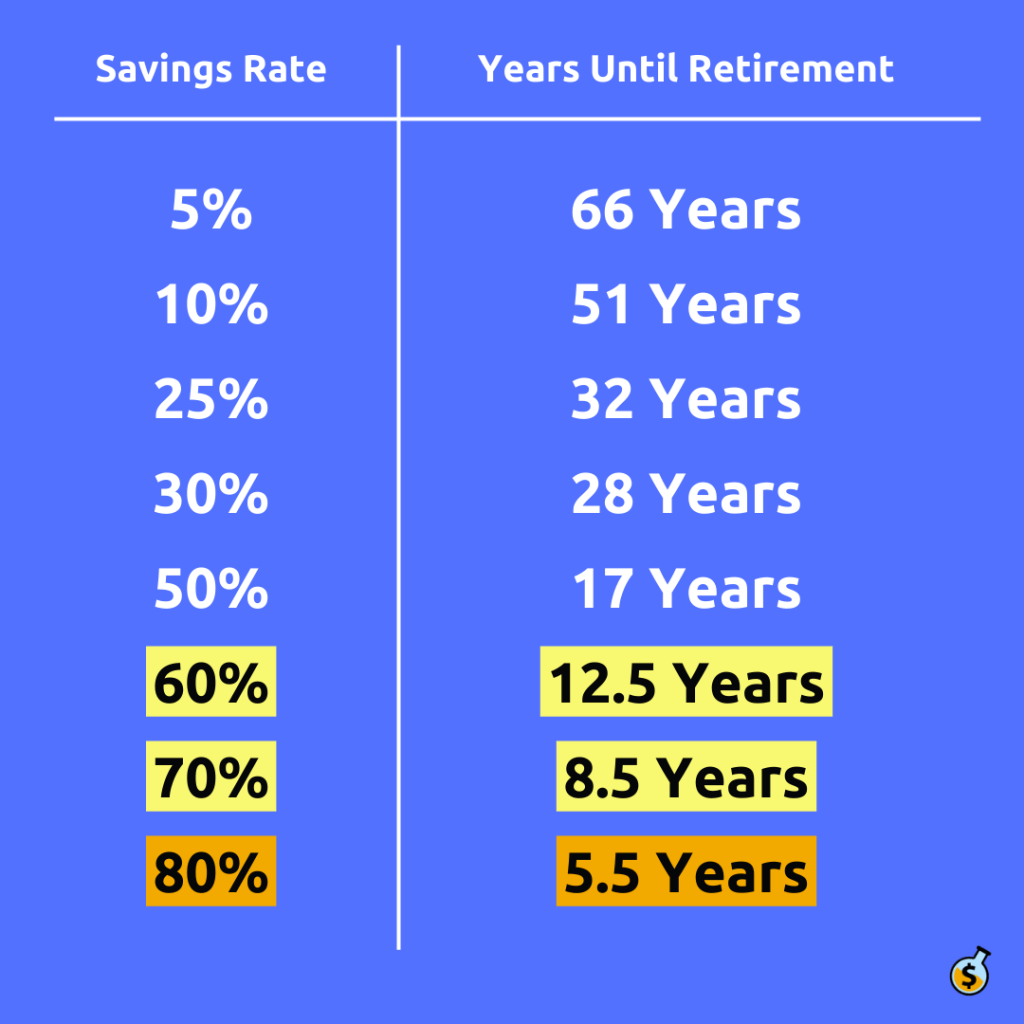

Let’s refer back to our early retirement calculator…

Because if nothing else changes increasing your savings rate from 50% to 60%…

…means you’ll be able to retire 4.5 years sooner.

Fight Back Against Lifestyle Creep

Remember that lifestyle creep can happen unconsciously.

Oftentimes, it is the default path.

You earn more money, and so you spend more money… without even thinking about it.

And so it’s important to stay vigilant and make intentional choices about your finances.

By following these tips, you can avoid lifestyle creep and maintain financial stability, even as your income increases.

To your prosperity,

Wealth Potion

Pingback: #013: Personal Finance Tips for Living in a VHCOL City