…But What Does it All Mean?

In case you missed the news, the Fed just cut interest rates by 50 basis points (bps).

It’s kind of a big deal.

This is referred to as a pivot, where the Fed does a 180 on its monetary policy.

And it’s been a long time coming.

Today, we’re going to break last week’s news in simple terms:

- What is the Federal Reserve?

- What are rate cuts and rate hikes?

- What does last week’s 50 bps rate cut mean?

- What did the Fed say in their announcement (and why is this important)?

- What I’m doing with my investments, and what comes next.

Let’s dive in.

What Is the Federal Reserve?

The Federal Reserve, or “the Fed,” is the central bank of the United States.

They have two main goals, which is often referred to as the dual mandate:

- Maximum employment

- Stable prices

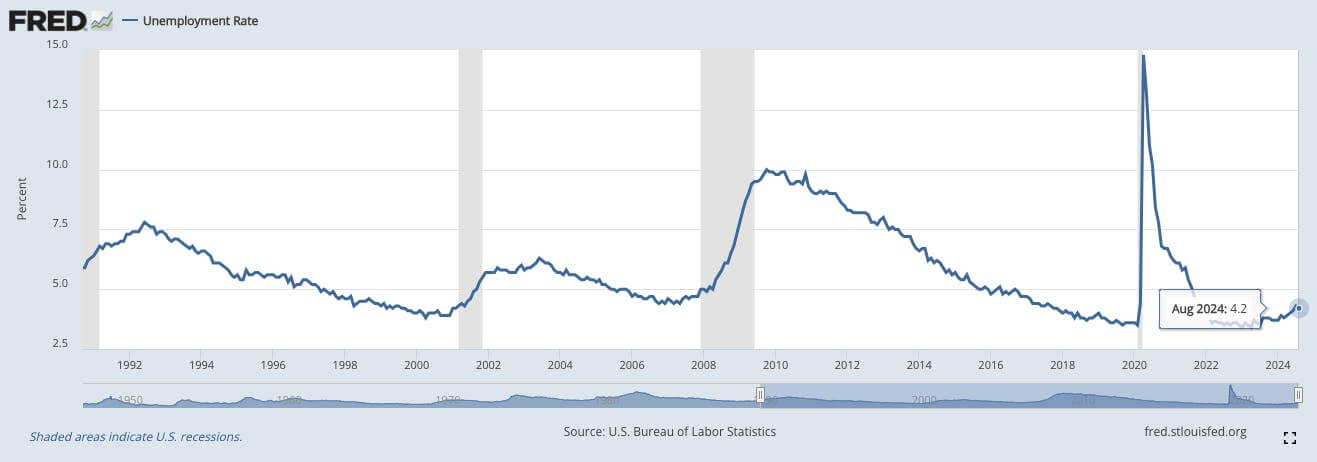

Maximum employment is straightforward – they want the unemployment rate in the United States to be as low as possible.

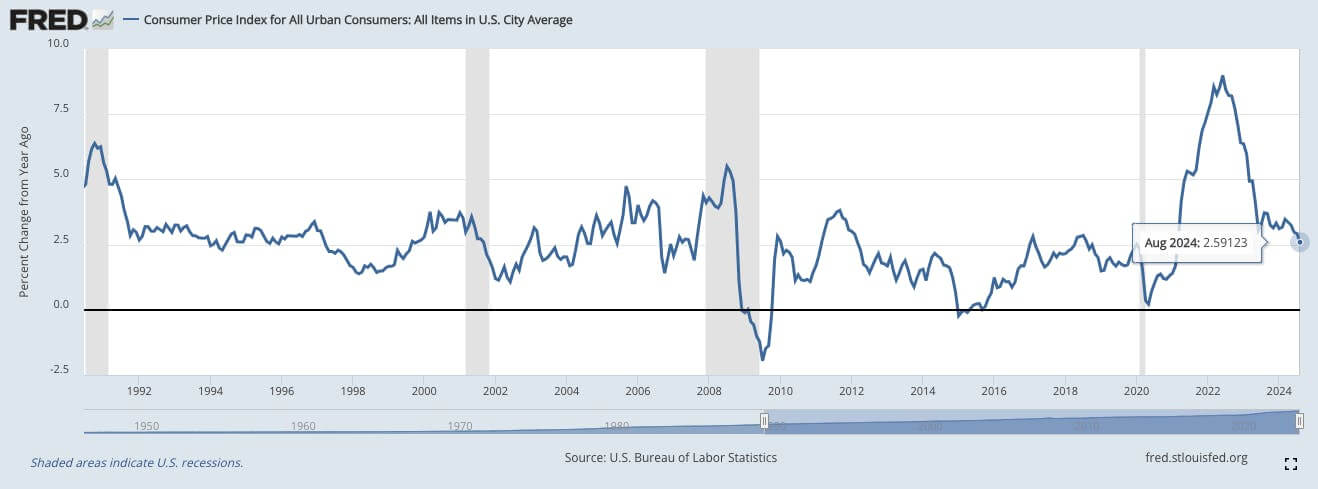

Stable prices is a bit more complicated. Prices in the economy are often measured by the annual % change in CPI (the Consumer Price Index).

But the Fed doesn’t want zero inflation.

The Fed operates within the belief system that 2% inflation is ideal for the sustained growth of the economy.

This is why the Fed’s target inflation rate is 2%.

If that idea – that our money being debased 2% every year is a good thing – strikes you as odd… then stay tuned. We’ll be posting more videos and writing more articles on the origins of the Federal Reserve, where the target inflation rate comes from, and more.

Alright, so we’ve covered what the Fed is, and what their goals are.

So how do they achieve those goals?

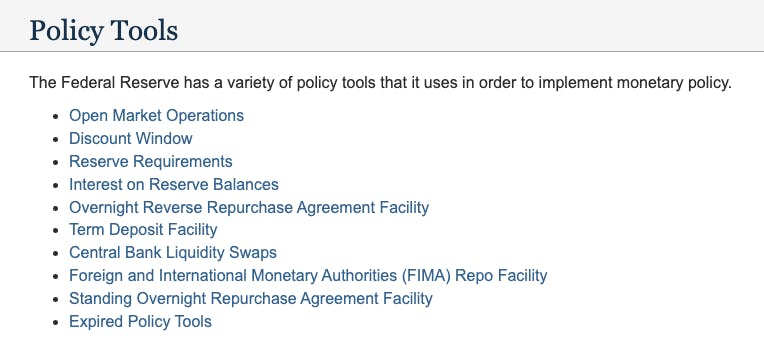

The Fed has many tools in its toolkit, and we won’t be going over all of them today.

But one of the most important tools the Fed uses is adjusting interest rates.

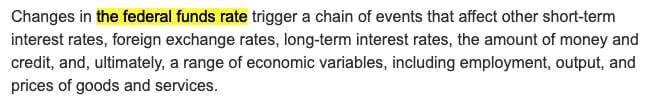

Technically speaking, the Fed adjusts the federal funds rate (also known as the overnight rate) which is the interest rate paid by commercial banks when they loan money to each other (often done overnight to balance their books).

Banks want to make profit, so the interest rates they offer to you via mortgages, car loans, student loans, etc. are almost always higher than the federal funds rate.

To put it simply, the Fed only directly controls the fed funds rate, but their actions cascade through the economy and affects all other interest rates, and by extension, the economy at large.

When the Fed cuts rates, it makes your interest payments less expensive, resulting in you having more money, which stimulates the economy.

When the Fed hikes rates, it makes your interest payments more expensive, resulting in you having less money, which slows down / tightens the economy.

So far, so good?

Now, we’re ready to discuss the rate cut that happened last week.

What Did The Fed Do?

On September 18th, 2024, the Fed lowered the federal funds rate by 50 basis points—from 5.5% down to 5%.

This is the first rate cut since March 2020 (remember that?), where they lowered rates by 50 bps, and then again by 100 bps in a series of emergency measures.

So why is last week’s rate cut a big deal?

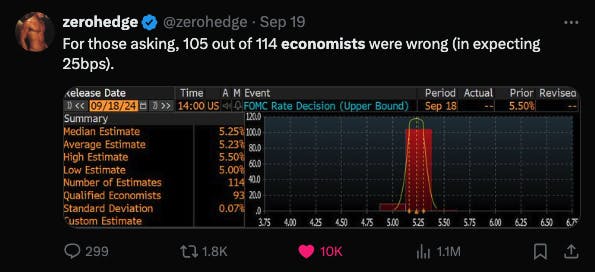

Firstly, because they cut rates by 50 bps instead of 25 bps. And over 90% of economists thought that they would cut by 25 bps.

Secondly, this is a big deal because we’re coming off the back of 2022 and 2023, when the Fed hiked rates faster than ever before in an attempt to tame inflation.

This is what’s called a pivot, meaning that the Fed has changed the direction of their monetary policy.

So now you’re getting a sense of how powerful the Fed is.

But it gets even better than that.

Because what the Fed says has power too…

What Did the Fed Say?

A few weeks back, I talked about a phenomenon known as ‘forward guidance’.

In case you missed it, I’ll recap quickly.

Forward guidance is how the Fed communicates its future plans—especially when it comes to interest rates.

Essentially, the Fed gives the markets a heads-up about what’s coming next. When they cut rates or hike them, they also hint at their future intentions.

And these hints alone have the power to move the markets.

So what exactly was said, and what was hinted?

Well, we need to read between the lines a bit.

Let’s take a look at the transcript from last week’s FOMC press conference, where Jerome Powell (Chair of the Fed) announced the rate cut.

Powell is clearly striking an optimistic tone:

“This decision reflects our growing confidence that, with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2 percent.”

But then, JPow continues.

Labor markets are cooling, unemployment is moving up, and nominal wage growth is easing… that doesn’t sound very good!

So what’s going on here?

JPow has a very difficult job. He has to strike the perfect balance.

If he comes out and says the economy is weak, it could create panic in the markets – and make the economy even weaker.

It’s like a giant game of chicken.

- Jerome Powell cuts rates (suggesting the economy is weak), but says the economy is strong

- Institutional investors then read the tea leaves to see what the Fed really thinks

Does this all seem a bit… silly to you?

Well, it might shock you to know that the bleeding edge of financial analysis comes down to analyzing the words of Jerome Powell in meetings like this.

The bottom line is this:

The Federal Reserve is extremely powerful and the very words they use have the power to alter the global economy.

And we will be doing more articles and videos on these topics, so stay tuned:

What Comes Next?

Alright great… so now what?

As mentioned earlier, prior to this rate cut, we lived through the fastest rate hikes in the history of the Fed.

So if you were shocked at your mortgage payments, you were not alone.

So the ultimate question is: Did the Fed cut rates fast enough?

If yes, we will get what’s called a ‘soft landing’ – unemployment will stop rising, inflation will stay low, and we will avoid a recession.

If no, we will likely get a ‘hard landing’ – unemployment keeps rising, and the US enters a recession.

As I’ve said before, I don’t have a crystal ball.

But we are very likely going to see more volatility in the coming weeks and months.

And so I’ll be following the likes of Warren Buffett who has been increasing his cash position, which signals that he doesn’t see any assets worth buying at these prices.

Here are some topics that I’ll be breaking down that you can look forward to in the coming months:

- Warren Buffett’s cash strategy

- M2 money supply and what it’s telling us

- Net savings as a percentage of GNI – How much are consumers saving?

- Insider trading – What are corporate executives doing with their stocks?

Hope to see you there.

Build in Public Update

I had a few tweets go viral this week talking about… ayahuasca, believe it or not.

Engagement is great, especially as I’m working toward getting my X account monetized (requiring 5,000,000 impressions in 90 days) but tweeting about psychedelics is arguably not going to attract people who are interested in growing their wealth.

Nevertheless, replying to large accounts on X (especially if you catch a tweet before it goes viral) has been very effective at attracting eyeballs.

YouTube has been growing slowly and steadily, and TikTok is still on the back-burner.

While my growth numbers haven’t been stellar, I am very much enjoying the balance I have in my life right now:

- I’m eating healthy

- I’m working out daily

- I’m sleeping ~8 hours

- I’m talking to my parents every week

- I’m reading the Bible and praying daily

- I’m chipping away at my Korean language workbook

Slowly ramping up the content, but I’m not rushing it.

“Do it for decades.”

– Graham Weaver

To your prosperity,

Brandon @ Wealth Potion