Protecting Your Wealth from Unpredictable Events

A “Black Swan” refers to an event that is rare, unpredictable, and has a massive impact.

Think 9/11, the 2008 financial crisis, or the COVID-19 pandemic.

Unfortunately, they seem to be happening more often.

Today, we’ll cover:

- WHAT are Black Swan Events?

- WHY are they happening more often? (or are they?)

- HOW to protect your wealth from Black Swans

- And of course, the Build in Public Update 🧪

Let’s dive in.

What are Black Swan Events?

Popularized by Nassim Nicholas Taleb in his aptly-named book “The Black Swan: The Impact of the Highly Improbable”, a Black Swan Event is a metaphor used to describe unpredictable events that have an oversized impact.

To understand it’s origin, we re-visit Ancient Rome.

The expression “rara avis in terris nigroque simillima cygno” or “a bird as rare upon the earth as a black swan” was coined around the 2nd century AD. It was an expression used to describe something exceedingly rare, and it was based on the presumption that a literal black swan did not exist.

For ~1500 years, this belief was held and was commonly referenced. Let’s call this belief (and all the knowledge based upon it) a system of thought.

This system of thought held for a long time… until 1697, when Dutch explorers found actual black swans in Australia.

Once a black swan was observed, its mere existence invalidated all prior knowledge that was based on the presumption that black swans don’t exist.

The entire system of thought is called into question. To paraphrase Taleb:

A “Black Swan” is a rare and unpredictable event has the potential to invalidate a system of thought by revealing it’s fragility.

What are some fragile systems of thought that many of us adhere to today?

- “Buying a house is a guaranteed path to wealth. Your parents and grandparents did it!”

- “The US economy is too big to fail. The USD is the global reserve currency after all!”

- “The stock market always goes up in value. Buy the dip, and never sell!”

- “The human population always increases, just look at history!”

I could go on.

These systems of thought work just fine… until a black swan invalidates them.

Let’s now talk about why black swans are happening more often.

Why Are Black Swans More Frequent?

But first, is it even the case that Black Swans are more common?

Of course we all experienced first-hand the black swan events such as COVID-19, the Great Financial Crisis of 2008, and so on.

But anecdotes are insufficient to demonstrate that they are indeed more common.

Let’s consider a few data-points:

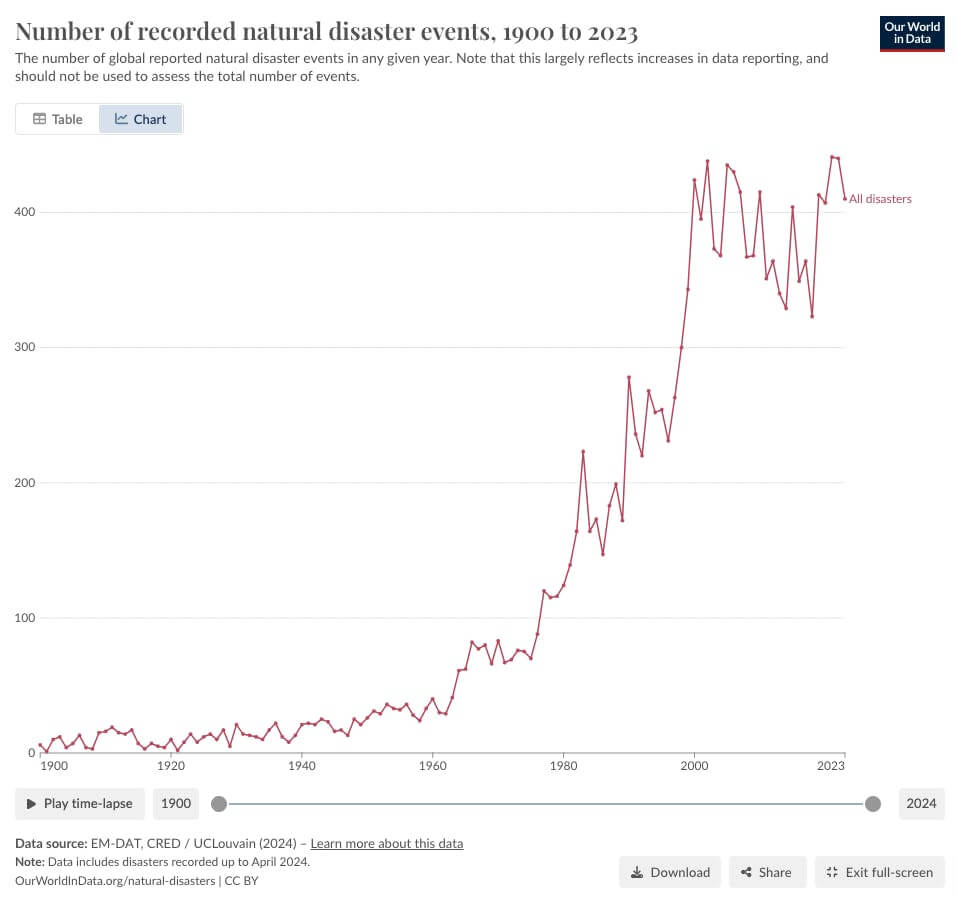

Firstly, natural disasters are becoming more common. The Centre for Research on the Epidemiology of Disasters (CRED) data makes this clear:

Hmmm, ok. But CRED themselves point out that this could be an increase in the # of reports.

Let’s look elsewhere.

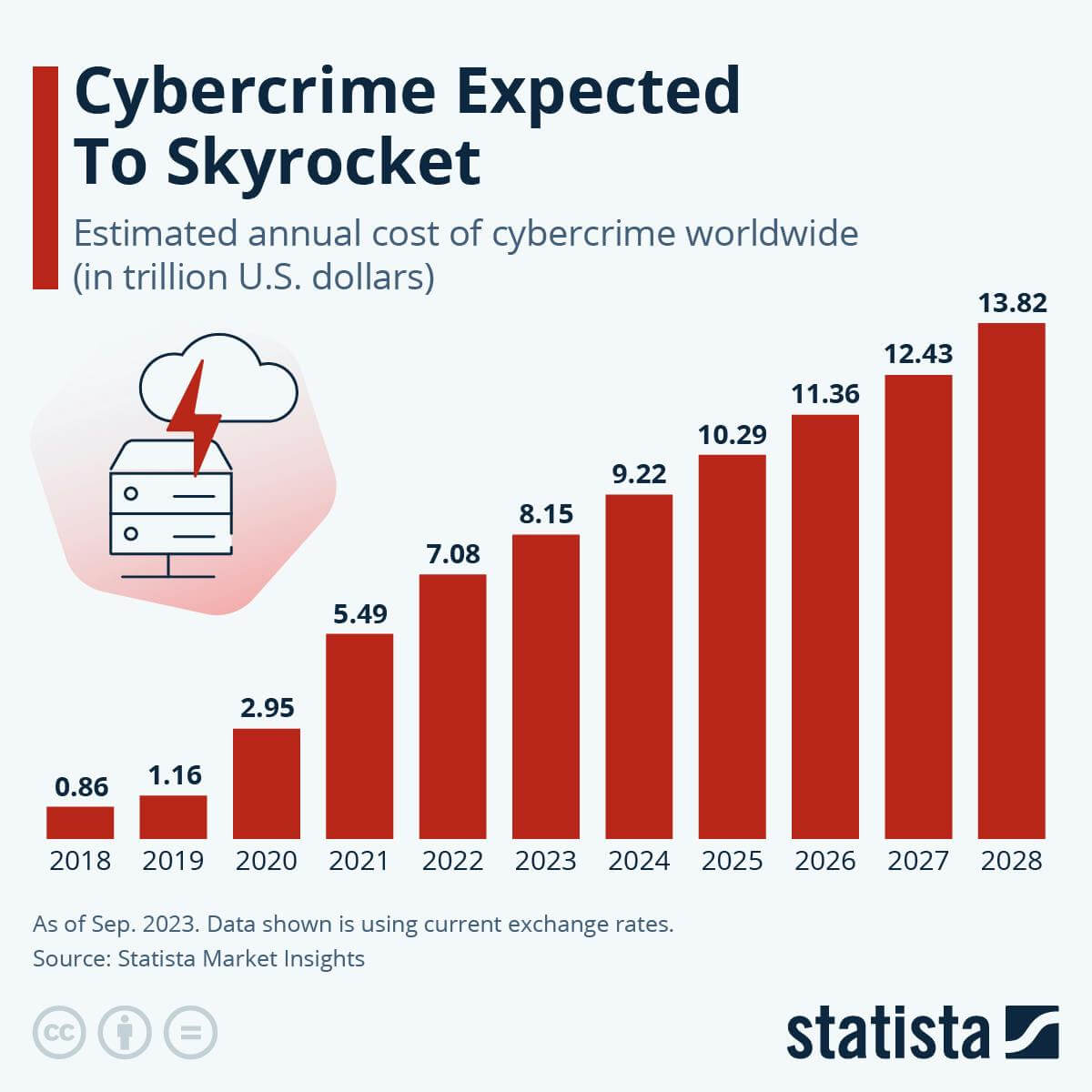

Secondly, cyberattacks are becoming more common. Not only that, but they are becoming more impactful, resulting in more money stolen.

Data from Cybersecurity Ventures predicts that the cost of cybercrime will reach $10.5 trillion annually by 2025, up from $3 trillion in 2015.

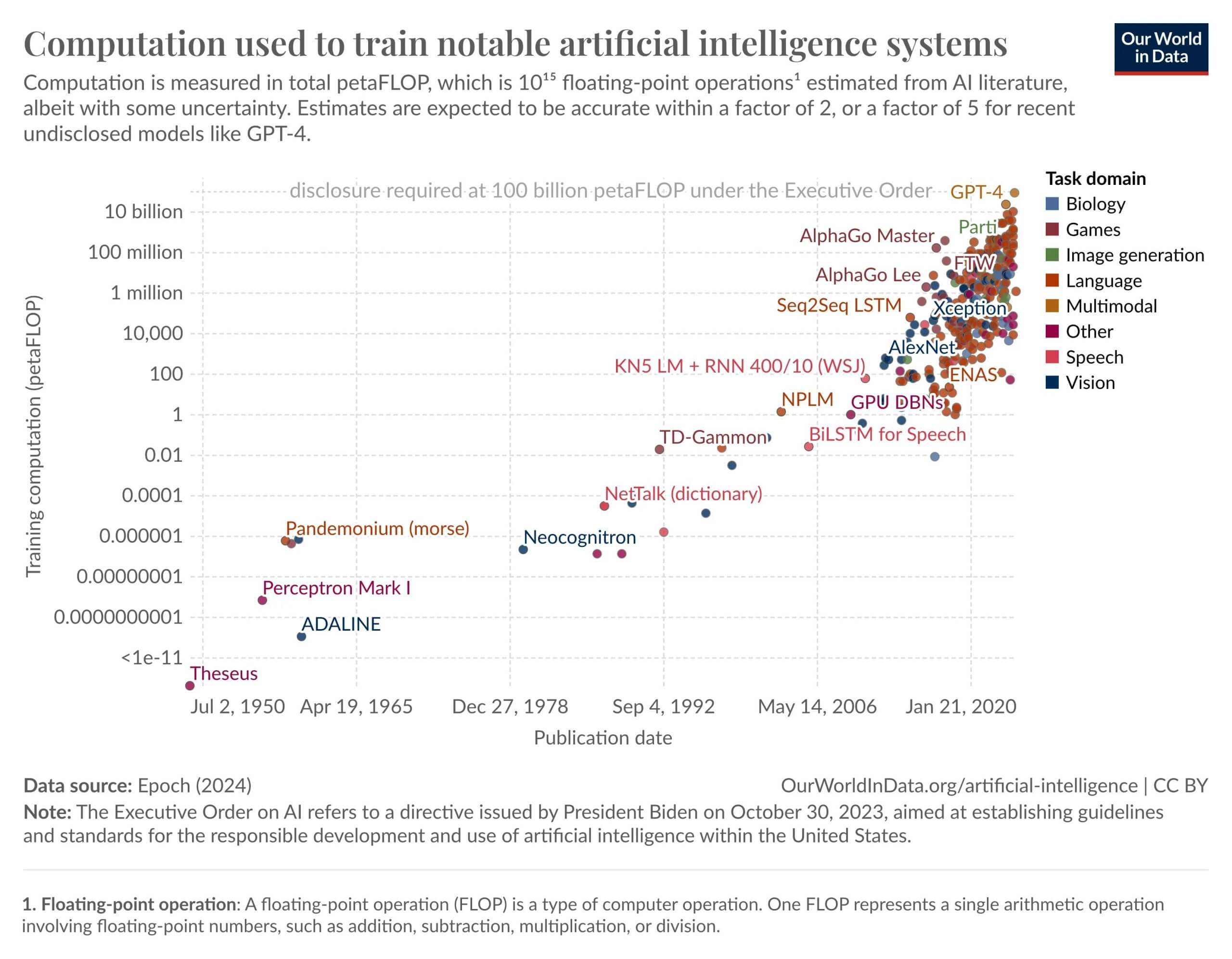

Thirdly, AI models are getting exponentially more powerful. This inevitably results in a greater risk of falsified information, “hallucinations”, and deepfakes.

At this point, you might be thinking:

“Wait, how do natural disasters, cybercrime, and AI show that rare and unpredictable events are more common?”

Consider this: in order for something to be unpredictable, it must not be accounted for in the prior system of thought.

For the discovery of the black swan in Australia to be impactful, there had to be a prior belief that black swans do not exist.

As technological innovation accelerates at an exponential pace, and the world becomes more globalized and interconnected, we not only expose ourselves to more risks, but we amplify the potential impact of those risks.

And as I’ve shared before, the human mind struggles to comprehend exponential growth.

And if you think you understand exponential growth, watch this video from 2:23 to 3:56:

In “The Black Swan”, Taleb points to an underlying factor that brings about Black Swans and makes them impactful: complexity.

Modern society is incredibly complex.

Complex systems—like the global economy or the internet—have many interconnected parts. And each of these parts interact in unpredictable ways.

As an example, the COVID-19 pandemic was more deadly because of how globalized the world is. Once the virus makes its way onto a plane… it can travel anywhere and everywhere.

When one part fails, it can cause a chain reaction, leading to a Black Swan event.

As society becomes more complex at an exponential rate, we increase the surface area for Black Swans exponentially.

How To Protect Your Wealth From Black Swans

You might have chuckled at the title of this section.

“How can I possibly prepare for a Black Swan if they are, by definition, unpredictable?!”

Prior to writing The Black Swan (and many other great books), Nassim Taleb worked in Wall Street.

And one of the funds that he continues to advise, Universa Fund, is positioned specifically to protect investors’ wealth from Black Swan events.

Without diving deep into the mechanics of the fund, its purpose is simple:

Maximize convexity i.e. the amount of portfolio loss protection provided to its investors.

Universa Fund loses money every year, on average. And then it wins big when a Black Swan event occurs.

During COVID for example, the fund made a 3,600% return. Yes, you read that right.

Put simply, Universa is a “hedge” in the most fundamental sense.

By putting some of your money in a hedge, it protects the rest of your investments from a dramatic loss in value.

Here are some ways you can hedge your wealth:

- Diversification. Don’t put all your eggs in one basket. Or use diversified instruments like index ETFs.

- Insurance. This includes traditional life insurance, but also leveraging negatively correlated investments (e.g. Gold, Bitcoin)

- Emergency Fund. Always have cash on hand ffr emergencies, or for deploying in the event of a recession.

- Be Open Minded. As we discussed last week, open-mindedness and mental flexibility is critical. When everyone is buying, it’s often a good time to consider selling.

These are all topics we’ll dive into deeper in future articles, as well as future YouTube videos.

Because building wealth and protecting wealth are two different activities that should be treated as such.

My mission with Wealth Potion is to make building and protecting your wealth more engaging, more approachable, and more actionable.

Build in Public Update

When people ask me what I do now, I don’t feel like it’s right to say I’m a “full-time content creator”. I usually just tell them I’m on a sabbatical.

“Full-time” suggests that I’m treating this as a full-time job, which I’m not.

And while that certainly is my eventual goal, I am being very intentional about adding more “work” gradually.

One of the reasons for this, is that being a Creator is different from a normal full-time job because there is no separation between work and life.

As a Creator, you can always be doing more. There is no off switch. And many Creators I’ve spoken with struggle with “turning off”.

I don’t know Kallaway personally, but this video really resonated with my early experience, and what I’ve heard from other “full-time” Content Creators. In particular, #1 (Off Switches) is what I’m referring to above.

My solution to this? Pre-empt it. Don’t jump straight into 40 hour weeks creating content.

Instead, I’m taking a minimalist, or ’Slow Productivity’ approach to becoming a Creator.

“Slowing down isn’t about protesting work. It’s instead about finding a better way to do it.”

– Cal Newport

Now that I’m back from Tokyo, I’m starting to ramp up my work hours. But I am still far away from going “full-time”.

And that is by design.

To your prosperity,

Brandon @ Wealth Potion

PS. Thank you to everyone who have been watching and commenting on my recent YouTube videos, the feedback means a lot. If there are topics that you’d like to see me cover in the future, never hesitate to comment or simply reply to one of these emails. I read them all 🙂