Most investing advice is written for the average person.

But you don’t follow Wealth Potion because you want average results, do you?

One of the most popular pieces of mainstream advice is “don’t time the market”.

Or more commonly, “time in the market beats timing the market”.

In fact, I’ve probably cited this quote myself.

While there is of course value in this advice, investing is not black and white.

In fact, I’d argue that when you are investing, you are always timing the market.

The Contradiction

By making a decision to buy an asset vs. not buy an asset, you are effectively timing the market.

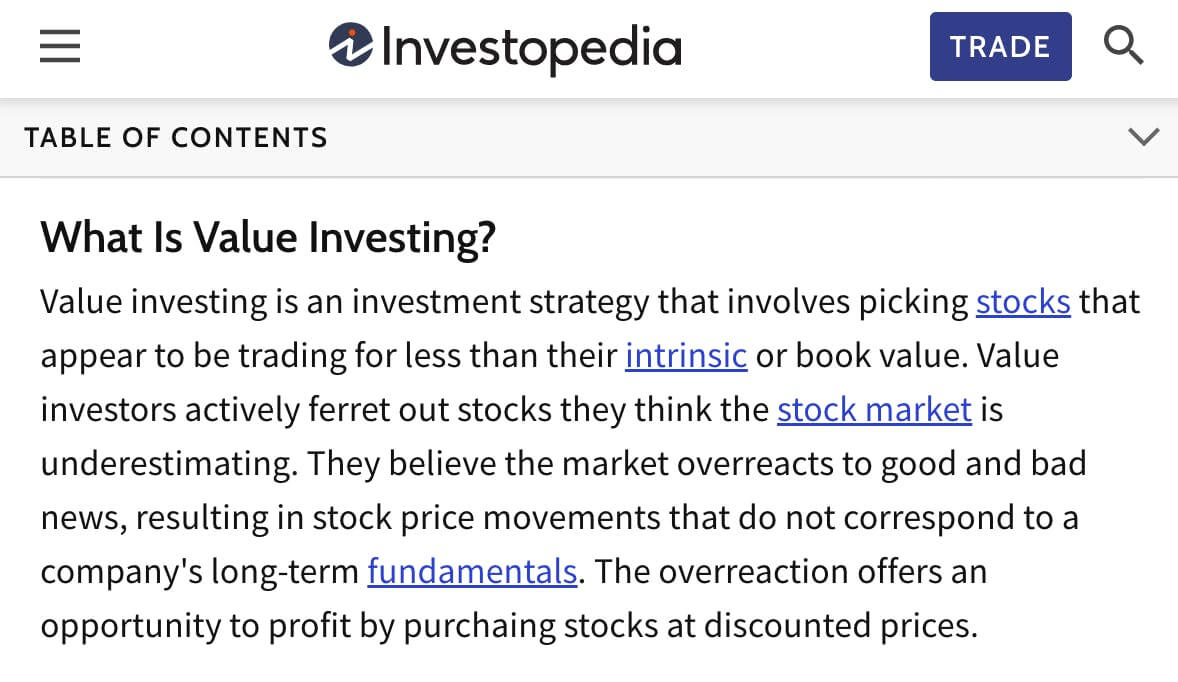

Warren Buffett is perhaps the most prolific value investor of all time, and yet value investing does not suggest you should be dollar cost averaging into assets at all times.

A savvy value investor knows the right time to buy and the right time to sell.

So why the contradiction?

This largely comes down to the definition of “timing”.

In the context of the mainstream financial advice, “timing the market” usually refers to trying to time the exact bottom of a drawdown.

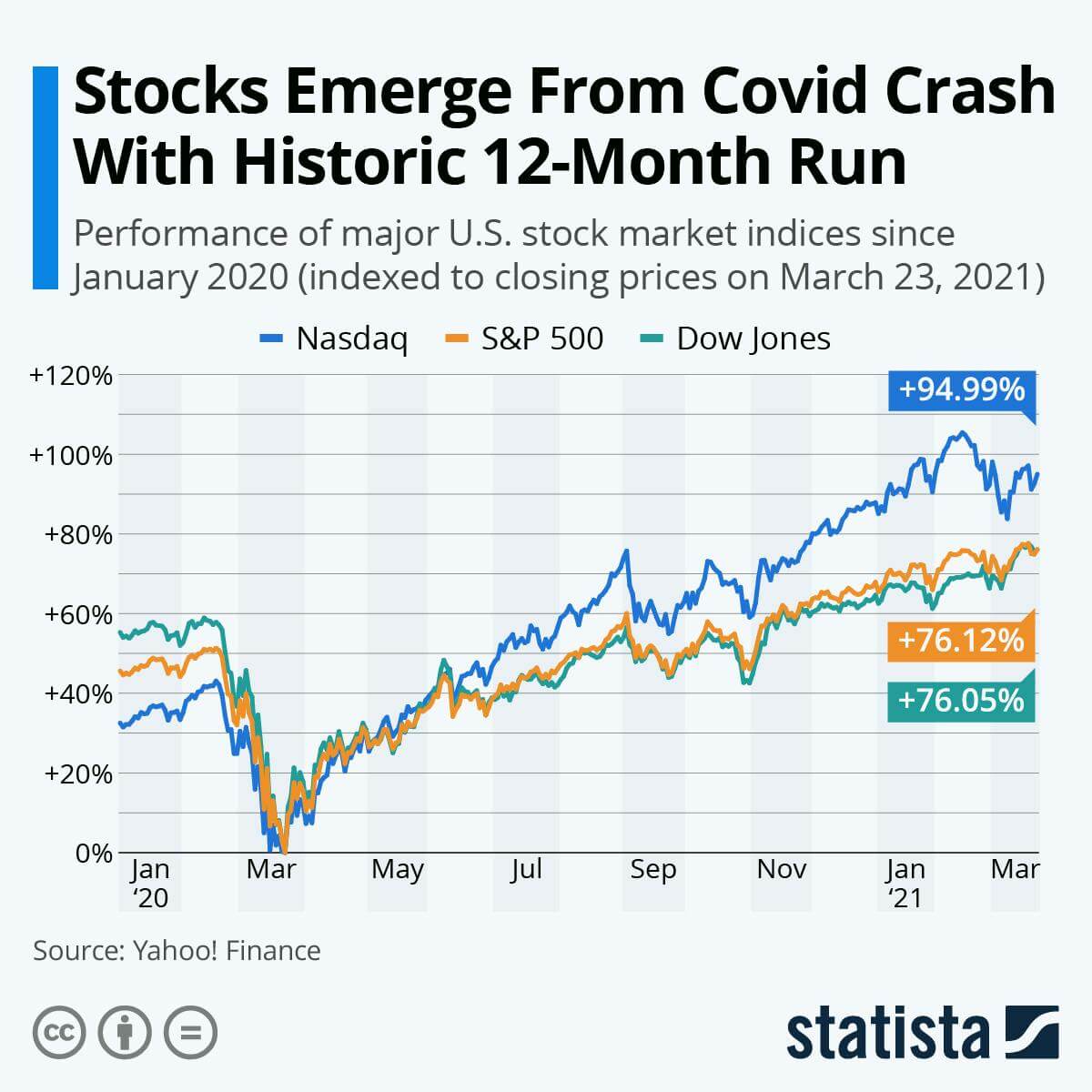

Let’s imagine a scenario where the stock market plummets.

A novice investor may be inclined to sell, and miss out on extraordinary gains.

An experienced investor would be deploying capital when the market sentiment is at its lowest.

Taken the wrong way, “timing the market” would be a very bad outcome.

Taken the right way, “timing the market” would be a very good outcome.

In other words, you’d be buying the dip.

Fading the Market

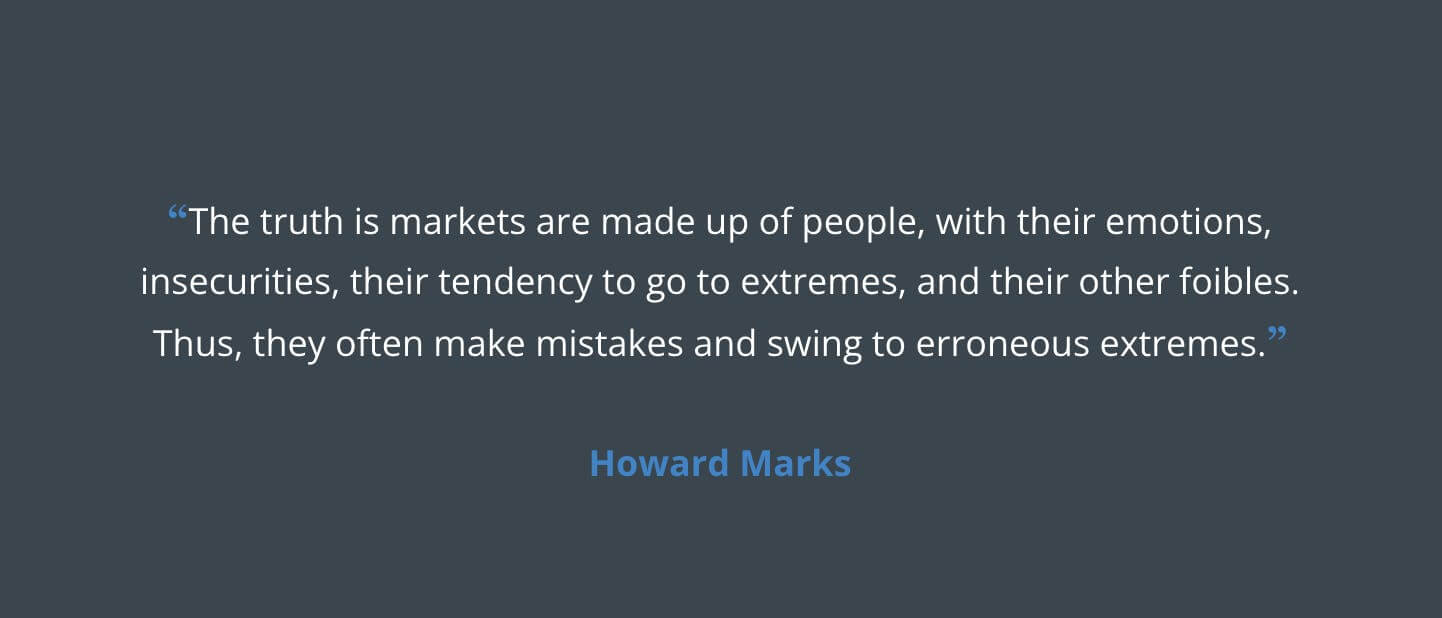

The contradiction boils down to human emotions.

When the stock market is at all time highs, by definition, this means that sentiment is positive.

The average investor is optimistic on the market.

Therefore, the average investor is buying, because they are feeling good.

The experienced investor would be much more cautious. In fact, they might even be fearful.

Instead of “timing the market”, consider “fading the market”.

This is where the concept of “fading the market” or a “market fade” comes from.

Experienced investors are able to take the temperature of the market, to get a sense of whethe the market is overbought or oversold.

Fading the market essentially means you are doing the opposite of the prevailing market sentiment.

And one way you can do this, is by buying the dip.

This is a risky strategy, because as Keynes once said “the market can stay irrational longer than you can stay solvent.”

But it surely beats selling your assets because you are afraid.

Key Takeaways

- Emotions and investing do not mix. Be wary of your own emotions.

- Being aware of the emotions of others can be a huge advantage.

- Instead of “timing the market”, consider “fading the market”.

(This is not financial advice. This is for educational purposes only, so that you understand the meaning and importance of fading market sentiment.)

Wealth Potion Update

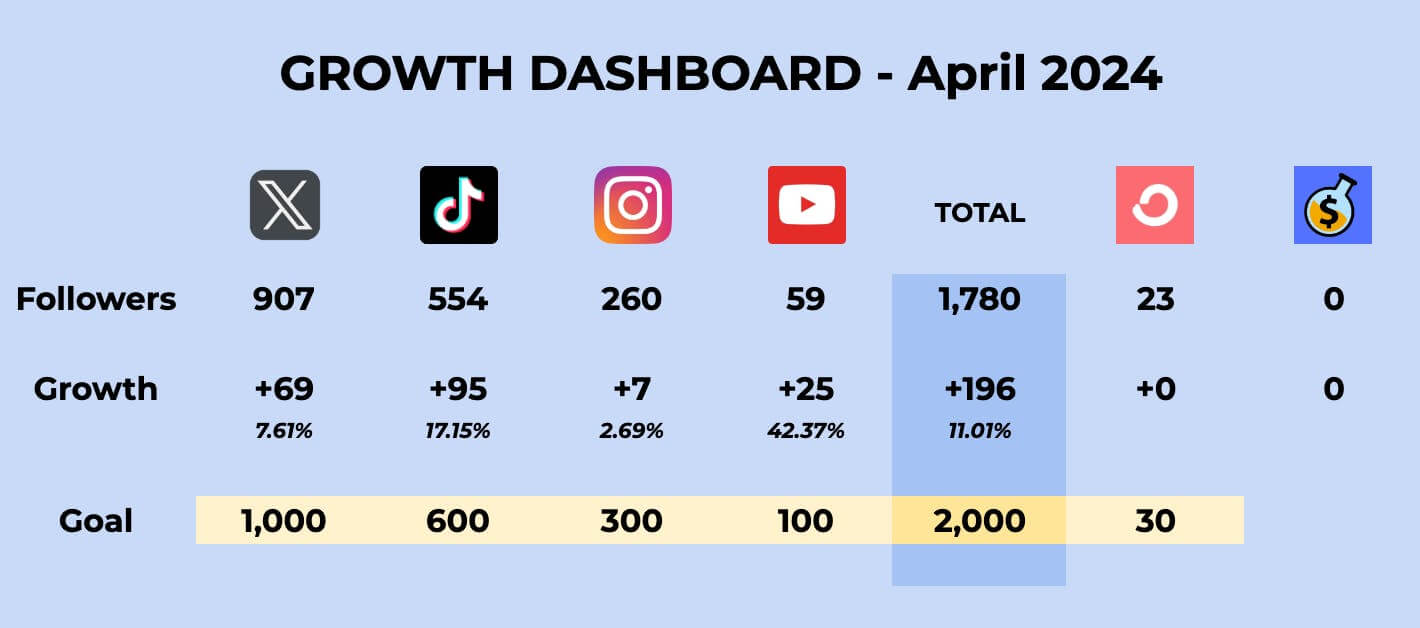

As I shared in last week’s newsletter, I’m starting a new segment where I openly share the metrics for Wealth Potion so you can follow along my journey.

I’d love to hear from you. Reply to this email, or send me a DM if you have questions, feedback, or would like to see anything else in future updates.

We’re halfway through April and I’m tracking well on my follower goals. My next step will be to build products and services and add them to my website.

Here are my main goals for the rest of April, and into May:

- Officially “launch” Wealth Potion on my personal social networks

- Build my first free / low-cost product as a lead magnet

- Record my first long-form YouTube video

As always, thanks for tuning in. And see you soon.

To your prosperity,

Wealth Potion

Follow Wealth Potion on social media for more exclusive content:

+

If you enjoyed reading, consider forwarding to someone who would find this valuable.

You can read all our previous newsletters here.