“Save your money!”

This has been the personal finance mantra that you’ve probably heard most of your life.

You heard it from your parents, relatives and teachers when you were young.

There’s only one problem:

It no longer works.

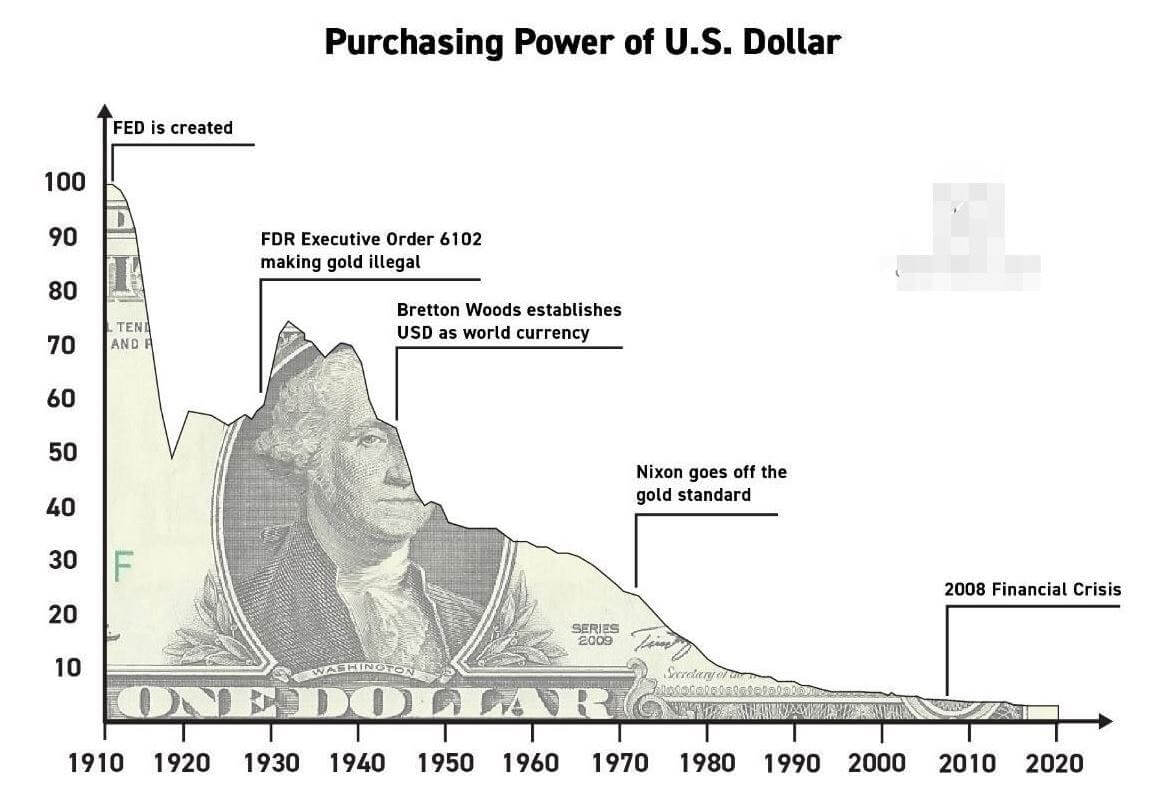

Money is Losing its Value.

And if you’re not from the US, it’s likely that your local currency has lost its value even faster.

You’ve heard the stories – your grandparents bought their house for $10,000 in 1950 and now it’s worth $5,000,000 in 2023.

Is the house 500x more valuable?

Or are the dollars less valuable?

This devaluation of currency is due to a phenomenon known as inflation.

Inflation means that the prices of goods increase over time. Or to put it another way, your dollars are able purchase less and less over time.

And inflation is a phenomenon that the government wants to happen.

Why do we have Inflation?

Well, because economists have convinced the world that inflation is required for a functioning economy.

In fact, central banks around the world have a “target” of 2% inflation. Meaning that they actively are trying to get your money to lose 2% of its value every year.

Why 2%? Even they don’t know.

The origin of the 2% target is an off-hand comment during a TV interview by New Zealand’s finance minister in 1988.

And so, “saving money” has become more of a figurative expression, and not something to be taken literally.

Because if you were to save physical cash, you would be losing 2% of it’s value every year.

Imagine an ice cube slowly melting away. That’s your cash.

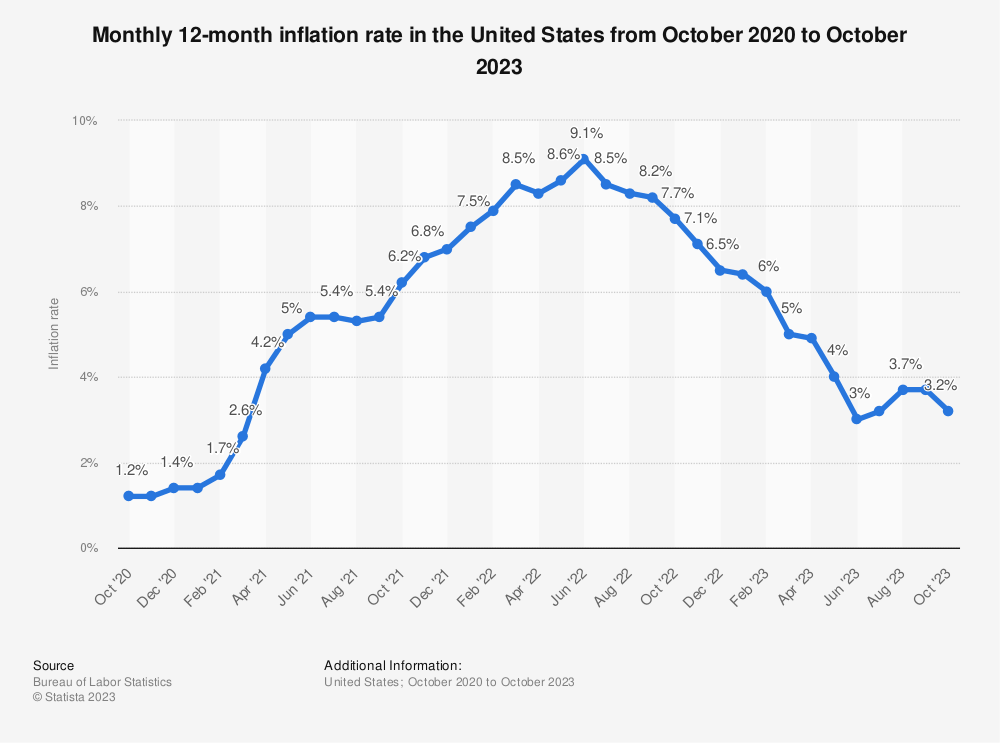

And that 2% by the way, is when the government has things under control!

They often don’t have things under control. Just look at the inflation rate these past few years:

Ok, so our cash is losing value. So what are we supposed to do?

Investing Your Money Became a Requirement

Simple – we started saying something else to young people:

“Invest your money!”

In other words, spend your money on assets – stocks, real estate, gold, bitcoin – that might appreciate over time.

The key word here is might. Yes, assets like stocks appreciate over time on average. But past performance does not guarantee future performance.

By investing in assets, you take on risk.

Don’t take my word for it, here’s an official statement from the SEC:

We’ve concluded that simply holding cash is a guaranteed losing strategy.

But in order to prevent your ice cube from melting away, you have to risk your money by buying assets like stocks just to keep up with inflation.

To put it simply, the inflationary monetary system we currently live in forces you to earn your money twice.

Key Takeaways

So let’s recap:

👉 Economists say that we need inflation.

👉 Inflation is causing our money to lose value.

👉 In order to protect ourselves from inflation, we need to invest our hard-earned money into assets.

👉 By investing in assets, we are risking our money.

We are being forced to risk our money because of this belief system that tells us that inflation is a necessary phenomenon.

Look, I don’t have the answers. But I hope this has challenged some of your assumptions about money, the economy, and investing.

🤔 Why do we need to invest our money?

🤔 How do things get more expensive over time?

🤔 Why does the economy need inflation to function?

🤯 What even is money?

These are powerful questions, that everyone should be thinking about.

And if these questions pique your curiosity, then you’ve come to the right place. Because at Wealth Potion, we’ll explore these questions. Together.

To your prosperity, Wealth Potion

Pingback: The Importance of Time Preference in 2024 - Wealth Potion